This post may contain affiliate links. Please read my disclosure for more information.

I know. Frugal living and fun do not go together. Just the word frugal is kind of a bummer. But being frugal and thrifty and finding ways to save money will improve your financial life.

And, extremely frugal living now can go a long way to making fun more possible in your future. If you learn how to be thrifty, it can help you save enough money to invest, and well, make more money!

But if you are spending everything you have each month, you will never get ahead.

Or you may be in a position now where you don’t have enough to make it and need some thrifty living tips just to get by.

In any case, adopting a frugal living strategy and becoming a thrifty person is not as difficult as it seems!

what Does it Mean to Be Thrifty and Frugal?

According to Mirriam-Webster, the word frugal actually means “using economy in the use of resources.” So, being a thrifty person means using or spending the least amount you can.

And to be thrifty means essentially the same thing as being frugal. A thrifty person = a frugal person.

The benefits of following spend-thrift guidelines can mean anything from being able to save money to buy your own house, start a business or go on your dream vacation.

19 Tips to being Frugal and Thrifty:

You might be asking yourself “How can I live a thrifty lifestyle?”

It is not as hard as you think! Especially once you get in the habit. Try these thrifty living tips and get started today.

1. Clip Coupons

Yes this may make you feel like your Grandma but one of the easiest ways to live a frugal life is to use coupons. Paying full price for anything means you are throwing money away.

Sign up for whatever loyalty program your grocery store provides. Places like Kroger will let you load digital coupons to your card. They also offer weekly specials and savings. Don’t miss these opportunities to save money.

Before you buy anything online, search for coupons first! Here are some great couponing sites:

Find out if you can use a coupon on the day it expires here.

Cut Your Phone Bill in Half!

Consumer Cellular provides the same cell service as the big guys but with no contract. Plans as low as $20 a month! Make the switch today and save hundreds.

2. Automate your savings

One tip on how to be thrifty that you must adopt is to set your monthly savings up on auto-pilot.

Don’t give yourself a choice on saving money, make it automatic. Follow these tips on how much you should save each month.

You can set up a portion of your paycheck each month to direct deposit into a savings account.

Or use a savings app like Acorns. What I like about the Acorns app is not only does it round up your change on purchases into savings, it actually invests that money for you. So while you are saving more money, you are also getting the opportunity to make more!

Check out this article “Is Acorns Worth It?”

Set Your Savings and Investments to Automatic with Acorns

Download the Acorns app, link it to your bank account and earn money while you sleep!

Acorns rounds up your spare change and moves it into an investment account for you. Download today and get a $5 bonus!

3. Get Free Stuff

Becoming a frugal person means paying for as little as humanly possible. The ultimate way to save money is to not spend it!

And, it is possible. There is actually a lot of free stuff up for grabs out there.

Next Door is a website and app for neighborhoods. People will post items for free that they want to get rid of. This also happens on Facebook.

You can get clothes, old tvs and more. And, for an added bonus see if you can resell these items on sites like eBay and turn a quick buck!

Here’s a list of sites where you can get free stuff!

4. Pay Down Your Debt

Probably the number one rule of a thrifty lifestyle is to not have or create debt. You should pay cash only for everything you buy.

If you do have debt, focus all your efforts on getting rid of it. Pay off as much extra as you can each month. Debt means interest which is a huge waste of money.

Want to download and monitor your credit for free?

If you want to check your credit report and score whenever you want to then download Credit Karma. This easy app lets you see your credit details whenever you want!

5. Live Within Your Means

This goes hand-in-hand with paying down your debt. Living the frugal life means living within your means and not buying anything on credit.

Only buy what you can pay for.

6. Start Budgeting

Start keeping track of your income and expenses each month in a budget. Track every penny you spend. Sticking to your budgeted expenses each month will help you be thrifty.

7. Cut the Cable

Wherever you can, cut out additional expenses. Cable and dish tv can cost as much as $200 a month. Cut that out of your life to save money.

You can opt for one streaming service like Netflix and spend $15 a month instead. There are so many money-saving options out there now when it comes to television.

Cut Your Monthly Expenses in a Hurry

BillTrim: Let this bill negotiation service cut your monthly expenses. It will monitor and pay your bills for you!

Consumer Cellular provides the same cell service as the big guys but with no contract, no activation fee and you can keep your phone number when you switch!

8. Workout at Home

Living a frugal lifestyle as a cheap person doesn’t mean neglecting your health.

But, there are still ways to do that more cheaply. Instead of spending $50-$100 a month on a gym membership, opt for home workouts instead.

There are tons of online workout videos you can follow instead and that cost you zero dollars! You can also consider buying used exercise equipment.

9. Downsize Your Lifestyle to a Thrifty one

Another thrifty living tip is to use less instead of more. And of course it means spending less. If your lifestyle is living large, you may need to downsize some things.

For instance if you have a $600 a month car payment, you can certainly reduce that to save money. Buy a used car with one lump sum and get rid of that monthly payment all together.

A car doesn’t have to be fancy to serve its purpose. And, it is an easy, often overlooked place to save a ton of money.

Is your house payment draining your bank account? Rent out that extra bedroom. Or if you want to be more extreme, sell it and buy something much smaller.

Another way to save money is to have a staycation instead of a vacation. The money you save on plane tickets and hotel stays could go a long way!

10. Make More Money

One overlooked way to improve your frugal skills is to actually make more money. The more money you have coming in, the easier it is to save money, and saving more means living frugally.

Plus, an added bonus is that maybe you can add a little more to your entertainment budget without causing an issue. You can actually spend money in this case! Making money is always going to improve your financial situation.

And if you don’t want the regular hours of a part-time job, you can opt for a side hustle instead.

You can monetize one of your hobbies, start freelance work in your field, or start your own blog or website. You can advertise your freelance services on sites like Upwork or Fiverr.

Driving for Uber of Lyft means you can do it as much or as little as you want, which makes it an ideal way to make extra money. Pick up a rider on your way to the grocery store and make your grocery shopping essentially free!

Finding ways to cancel out your expenditures is a thrifty living win.

In addition, investment options like annuities can also boost your finances by providing a consistent income stream, shielding you from market fluctuations.

While fixed annuities offer guaranteed returns, indexed annuities allow for market-linked growth. Additionally, annuities can serve as a tax-efficient tool, offering deferred tax advantages.

You can search the internet for annuity reviews to gain better insights and learn how to incorporate them into your financial portfolio to secure your financial future and provide peace of mind

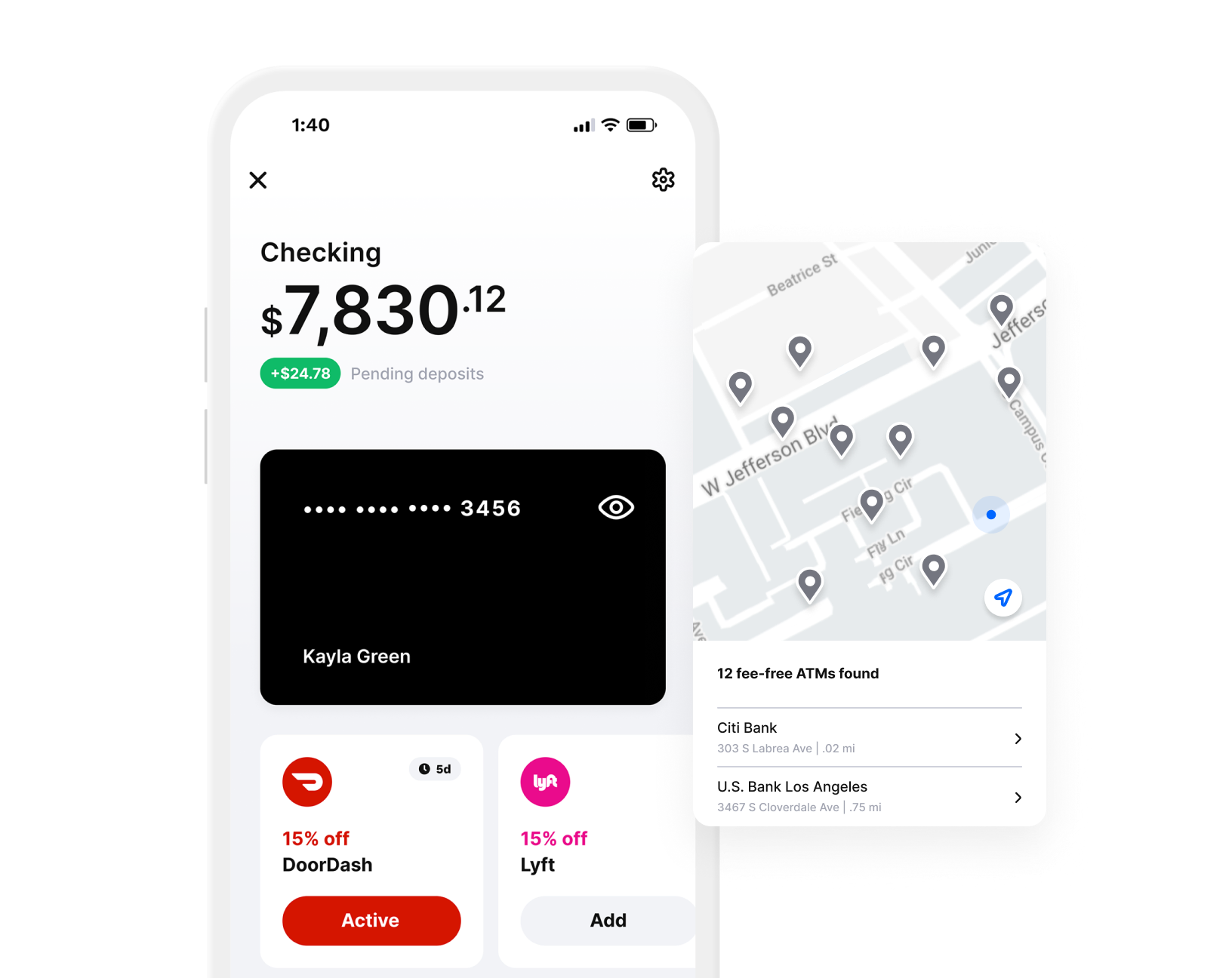

Albert Banking & Money App

Get up to $1,000 Instantly!

Albert: The only all-in-one banking and money app you need. Automatic saving and investing. 20% cash back on purchases and more!

11. Just Say No

Probably one of the hardest but most essential parts of the thrifty and frugal life. You have to learn to say no as a frugal person. Just don’t spend money.

Before you purchase anything, make sure it is a need and not just a want. It is ok to buy for yourself sometimes of course, but try to say no more often than not.

You can be thrifty by just saying no. Try to avoid temptation to make it easier on yourself. Don’t drive by your favorite boutique or go to the mall!

12. stop eating out

Eating out is a huge waste of money. And, it can frequently add to your waistline!

Eating lunch out will likely cost you $12-15. By contrast, making a meal at home may be $2-3. Multiply that savings by day and you are looking at about $3,500 in savings a year! That could buy you a new car, or an amazing vacation.

You should also take a look at your pantry! You may have tons of unused food you can make use of to prevent spending.

Living like other frugal people means looking at all the areas of your life where you can save, and food is definitely a daily expense.

13. Be Thrifty at the Grocery Store

Since food as we mentioned is a daily expense, we have more to say about that subject! Don’t let grocery shopping be a free-for-all.

Find ways to save money on food. Use coupons, take advantage of offers from your grocery store and buy food items like beans and pasta that are cheap.

You can also get cash back on your shopping trips by using an app like iBotta. After every time you spend money, you can get cash back!

14. sell unused items

Take a look at your closet and your garage. You may have hundreds of dollars in there in items you can sell!

If you have clothes you haven’t worn in aeons, sell them on a site like Poshmark or eBay. You can sell old tools, ski equipment and even small appliances.

The point is, turn your items into cold hard cash.

15. Do It Yourself

DIY has become a trend in categories like home decor. Frugal people don’t buy things, they make things. If you can do something yourself instead of hiring an expensive professional, the savings can be extreme.

Approach everything in your life with the thrifty, I can do it myself attitude. Not only will you save a lot of money, you might pick up some new creative skills.

16. Shop Sales and Clearance

If you do have to buy something, make sure you buy it on sale ore better yet, on clearance.

Keep an eye out for deals online and in stores. Wait until you see the item you want marked down.

You can save a lot by being patient with your purchases. And, by the way, thrifty people shop at thrift stores! Another of our money saving tips is to shop at your local Goodwill or thrift stores.

17. Cut Your SPENDING

Have you ever noticed how much money you spend on special items like lattes? Things that make you feel good or are impulse buys?

Living a frugal and thrifty lifestyle means finding ways to cut the crap out of your life and stop spending money unnecessarily.

Make an expense sheet of all things you can remember spending money on in the last few months so you can see where it all goes.

This will help you find ways to cut costs and put your money to better use.

You can also try a savings challenge like the 100 envelope challenge to help yourself save money.

18. Find Free Fun

Entertainment expenditures can kill a budget. Whether it is going out to eat, to a concert or event the movies, spending money on fun does not equal thriftiness.

But, there are many ways to have free fun as a cheap person that do not cost a dime! Go on a hike nearby or even camping.

Have a potluck neighborhood party! And use all your items already in the pantry of course.

Before you spend money, think of some free options to pass the time.

19. Buy Used Items

Everyone knows the tip about not buying new cars. That the second you drive it off the lot the value drips tremendously and it is just a big way to waste money.

But the same thinking can be applied to anything you purchase. You don’t have to buy everything new.

You can be even more frugal and thrifty by buying things used. If you need a new computer, you can save hundreds by buying one off Facebook Marketplace or Ebay.

From ski supplies, to clothes, to cars- buying used instead of new is an ideal way to change your spending habits.

Unusual Frugal Living Tips From The Great Depression

Nobody knows how to be thrifty better than the people who went through The Great Depression.

They had no choice but to live a frugal life and be thrifty. My grandparents did so many things that were extremely frugal because they had lived through that time. One of the best frugal living tips is to live like people from The Great Depression.

Here are some extreme frugal living tips from The Great Depression:

Grow Your own food

The Great Depression era frugal people foraged for food. They literally went out to look for fruit and nuts they could eat.

While this may not be a practical option in this day and age, you can start a vegetable garden to grow your own food and start saving money on grocery store bills.

Maybe growing your own food is an unusual frugal living tip, but it will also improve your health!

Barter for Things Instead of Paying for Them

Frugal people don’t pay for things. Find ways to trade for what you need rather than spend money.

If you are a good photographer, use your skills as money and barter with people in exchange for other services or goods.

You might be able to get your car fixed for free or who knows what else!

Wear Layers

Extreme frugal living means dropping your heat and just wearing lots of layers. Another of our money saving tips is to be aggressive with your HVAC and your utilities.

Recycle and Reuse

And I don’t mean recycle in the usual sense. In the depression times, people would make clothing out of flour sacks if they had to. They made toys from wood scraps.

They used ever thing they had to get what they needed if that makes sense! While you may not need be the cheap person that wears a potato sack as a cocktail dress, you can still adopt this attitude in your thriftiness.

Make it Yourself

During the tough times of the depression, if you needed something you just made it yourself. We already talked about DIY as a thrifty lifestyle tip, but it bears repeating!

Substitute expensive items

Back then there was no budget for meat. So people just didn’t eat that! They chose the cheapest food items possible, like beans, pasta and potatoes to live off of.

You can save a lot of money each month on your food budget with these tips.

Find alternate Transportation

Yes, this is an unusual frugal living tip, but if you really want to be aggressive you have to get a little crazy in your thrifty living choices.

During extreme times like the depression, people did not drive. They couldn’t afford cars or gas.

We all know the pain right now in 2023 of filling up the car with gas. Choosing to bus or bike to work might save you hundreds each month.

Plus, you could consider selling your car and investing the money instead. So that it makes you more money!

What are the Benefits of a Frugal Life?

Being thrifty carries with it many advantages. Believe it or not, becoming a thrifty person can help you get to a point where you don’t have to be as frugal.

As you improve your finances, you can get more breathing room. You can save money in order to invest, or start a business and actually make more money. At the very minimum you need to save money for an emergency fund.

Living paycheck to paycheck is not fun, and adopting a frugal lifestyle can help you avoid that.

Here are a few other benefits of living frugally:

Less stress

According to the APA, stress over money is a biggie in the lives of Americans. And we are all in survival mode right now! Especially with inflation on the rise.

Living a thrifty lifestyle and being a frugal person can help you reduce financial stress in your life.

Better sleep

Stress causes poor sleep. So if you can reduce stress by being frugal and thrifty, it stands to reason your sleep will improve.

Get out of debt

Did you know about 80% of Americans are in debt? But debt destroys your present and your financial future. And, if you are in debt you certainly can’t save money.

Adopting tips like the ones below on how to be a frugal person can help you get out of debt.

Improve your relationships

The number one reason couples fight and even divorce is money. So take that relationship stressor off the table by adopting a thrifty lifestyle.

Meet Your Goals

What is your financial goal? To save money? To make more money? To start your own business?

Figure out where you want to be, write it down and adopt these tips on how to be thrifty to help yourself get there.

More reading: What is the 30/30/30/10 Budgeting Rule?

How to Be Frugal and Thrifty

All of the tips above should help you to be thrifty and give you a start to living a frugal life as a (smart) cheap person.

It is actually possible to be thrifty and not be miserable! You just have to start and be serious about it.

As the saying goes, a penny saved is a penny earned! Start using some of these tips today and boost your finances!

Next Frugal Living Posts:

How Much a Year Do You Make From $18 an Hour?

21 Free Printable Budget Templates

How to Sell Gift Cards for Instant Cash

How Much is $15 an Hour Per Year?