This post may contain affiliate links. Please read my disclosure for more information.

We’ve all been in a situation where we could use a little financial help – whether we are facing an unexpected expense, trying to pay off debts, or simply need extra funds to make ends meet.

For many people, borrowing money from a friend or family member is not an option.

They may not have anyone who is able or willing to act as a guarantor, or they may prefer to maintain their privacy and not involve others in their financial affairs. In these cases, a no guarantor loan can be a lifeline.

What is a No Guarantor Loan?

With a no guarantor loan, an individual borrows money from a lender without having to have a guarantor who co-signs the agreement. In a guarantor loan, someone co-signs with you, so if you default on the loan, they are responsible.

However, you are the only person responsible for the debt and the loan repayment with a no guarantor loan. If you can’t pay, you are the person who will have to take any negative actions.

Loans for Bad Credit:

BadCreditLoans can help you get the money you need even with poor credit history.

How Does a No Guarantor Loan Work?

With a no guarantor loan, you do not need to find someone who agrees to repay the loan if you can’t. There won’t be anyone co-signing the loan.

Instead, the lender will consider your creditworthiness and other factors when deciding whether to give you loans with no guarantor.

While these loans often come with higher interest rates and additional fees than other types of loans, they can also offer a level of flexibility and independence that other loans cannot. And they can be helpful if you are in need of an emergency Loan.

The process to obtain a no guarantor loan is often simple and straightforward. You can apply for these loans online or in person, and the lender will typically give you a decision quickly.

If approved, you can typically receive your loan within a few hours or days. The repayment terms and schedule is often flexible, with many lenders allowing you to choose your repayment date or spread your payments over a longer period.

Since you are the only person on the loan, you will need to be able to show you can repay the loan.

In most cases you need to show that you have a regular job with stable income, a good credit score and positive payment history with other loans.

There are however some no guarantor loans for bad credit that are less stringent.

Need to Build Your Credit Fast? Try Ava or Kikoff!

Ava: You can get a line of credit fast with the Ava app. Plus, it can help boost your credit score quickly! Download the app!

Kikoff: Another fast credit building app.

What Types of No Guarantor Loans are There?

There are different types of no guarantor loans to choose from:

Payday Loans

A payday loan is something you get that helps you make it to the next payday if you don’t have enough cash in the meantime. You have to pay them back however by your next payday. And they have high interest rates so it will cost you a lot to take one out.

Personal Loans

A personal loan is a great no guarantor loan option. If you have good credit history, they can be relatively easy to get and even for larger amounts.

You can use these loans for anything you want, including consolidating credit card debt. And, if you have excellent credit, you can get them quickly.

Same Day Loans

In some cases you can get emergency cash with same day loans. This type of non guarantor loans carry high interest however and are expensive. They are also usually jus short term loans.

Title Loans

With title loans, you offer up the title of your car as collateral for the loan. So if you default on the loan and can’t make the monthly repayments, then you lose the car unfortunately!

These secured loans be a good option if you have a poor credit score. They are usually a short term loan however.

Bad Credit Loans

If you have a poor credit score you may need to opt for bad credit loans. The downside is these types of loans typically have very high interest rates and fees.

Sites like BadCreditLoans can help you find these. You can also look for secured loans like title loans.

Can I get a No Guarantor Loan with Bad Credit?

In some cases it is possible to get a no guarantor loan with a bad credit score or if you have poor financial circumstances. Certain companies will provide that but your interest rates will likely be very high.

In addition you may not be able to borrow very much, and the repayment times may be very short. You might also have to check with multiple lenders before finding something.

The rates and fees can vary from one lender to the next and depending on how bad your credit rating is. Guarantor loans are sometimes easier to get if you don’t have the best credit report and credit rating.

Our Top Credit Repair Service Company:

Sky Blue: Best overall value with an A+ BBB rating, free initial consultation and 90 day money back guarantee.

Is a No Guarantor Loan without a Credit Check Possible?

Because no guarantor loans carry more risk for the lender, it isn’t possible to get this type of unsecured loan without a credit check. Any loan application is going to involve a credit check.

Lenders are going to pull your credit and check it before giving you any money for this type of loan. They want to make sure you can make the loan repayments. You will also need to be able to show steady income on your loan application.

What Do I Need to Get a No Guarantor Loan?

You might be asking “How can I get a no guarantor loan?” There are a few things you will need for an unsecured loan:

Good credit rating: There are some lenders that will give you a no guarantor loan with a low credit rating, but in most cases you need a high credit score and positive payment history.

The interest rates will be lower in this case as well. Be aware that when a lender does a credit check, that can bring your score down a little.

Low debt-to-income ratio: For getting loans and having good credit, the lower your debt-to-income ratio the better. This just means the amount of your monthly take home pay that goes to paying debt. The more extra money you can show, the better chances you have.

Employment and stable income: You will also need to be able to show that you are receiving income every month from full time employment in order to get an unsecured loan.

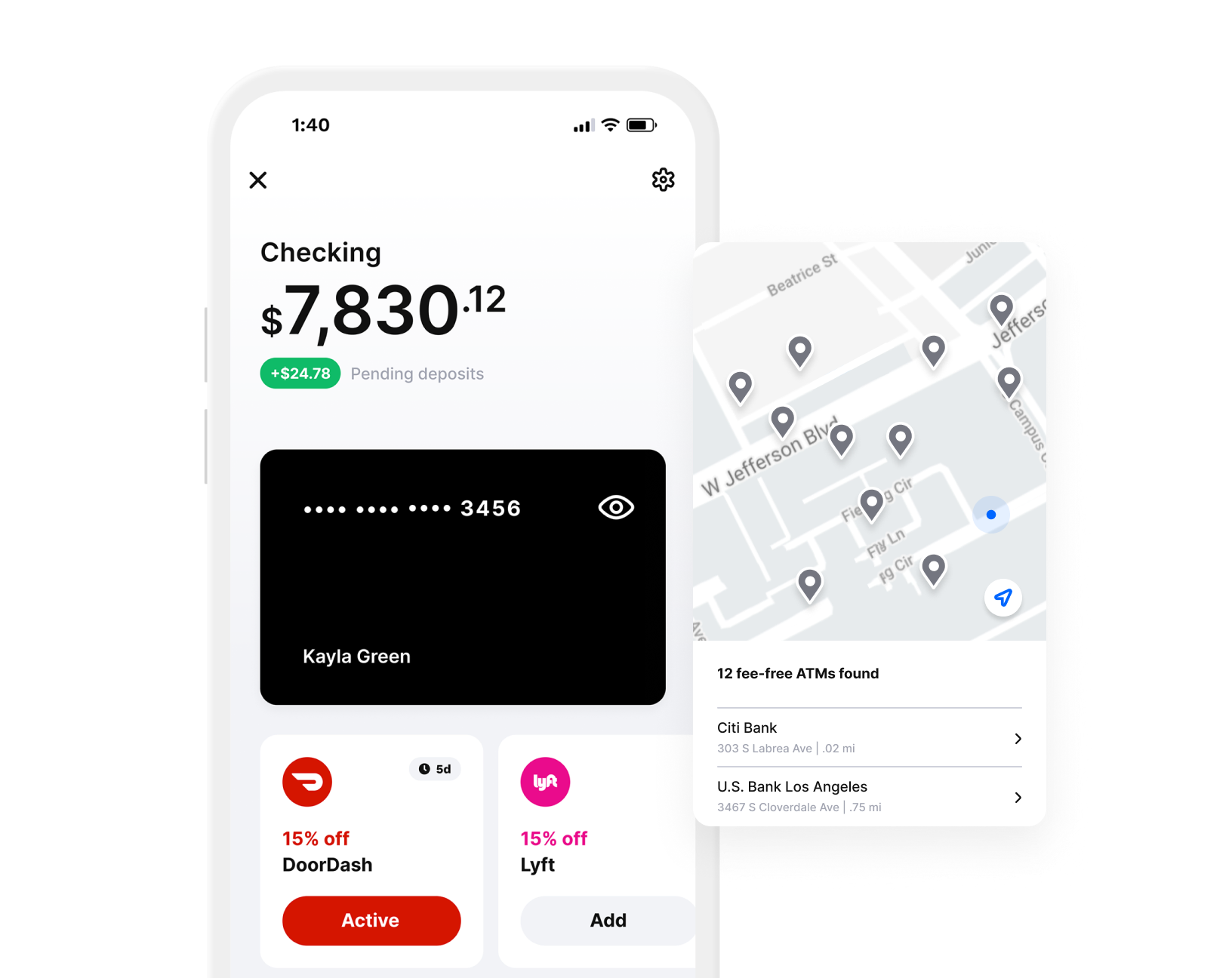

Albert Banking & Money App

Get up to $1,000 Instantly!

Albert: The only all-in-one banking and money app you need. Automatic saving and investing. 20% cash back on purchases and more!

What are the Advantages of a No Guarantor Loan?

No guarantor loans can empower individuals who are working towards financial independence.

Whether you’re just starting out on your own, looking to establish your credit, or working toward a significant financial goal, these loans can offer the financial support you need without requiring you to rely on a guarantor.

This independence can give you the freedom to make financial decisions that are best for you and your situation, without needing to involve anyone else.

There are some advantages to a no guarantor loan. For one thing, you don’t have the hassle of getting someone to co-sign your loan with you.

That by itself can be stressful and there may not be anyone who wants to do that. It also involves a lot more paperwork and it is a slower process to get a guarantor loan.

Another benefit is that there are a lot more options for no guarantor loans. There are many different types and you can shop around for the best interest rate and terms. Plus with so many options, your chances of getting a loan increase.

In some cases this type of loan can get you the money much more quickly. There are personal loans that will fund you as quickly as 2 days if you meet the requirements!

What are the Disdvantages of a No Guarantor Loan?

While non guarantor loans can be a useful financial tool, they should be used responsibly. Like any form of credit, these loans come with risks and costs.

It’s important to understand the terms and conditions of the loan before you sign on the dotted line.

You should make sure you can afford the repayments and are fully aware of any fees or charges. Failure to repay the loan could result in damage to your credit score and other negative consequences.

Some disadvantages of no guarantor loans include a higher interest rate and less options. When you have a guarantor it can sometimes meant he interest rates are better. But without a guarantor, you will have higher interest rates.

In addition, you may have limited loan options if you are applying for a no guarantor loan with a bad credit history.

Is getting a Loan Without a Guarantor More Expensive?

It depends on the type of loan and the lender. Non guarantor loans can be more expensive in many cases than an unsecured guarantor loan.

Frequently Asked Questions

What Does Guarantor Mean on a Loan?

A guarantor is basically a co-signer. When you have poor credit history, you may need to get a friend or family member to sign onto the loan with you. It will be easier for you to get an unsecured guarantor loan in some circumstances.

What is the Difference Between a Guarantor and a Non Guarantor Loan?

With an unsecured guarantor loan, you have another individual on the loan with you. A co-signer who is also responsible for the loan and the monthly repayments if you can’t make them.

But with a non guarantor loan, there is only you on the loan. Any missed payments will cause harm to your financial situation. You will need a better credit rating to be approved to borrow money with these loans without a guarantor however.

Is a No Guarantor Loan Better Than a Guarantor Loan?

It depends. On your particular financial situation, your credit report and credit history as well as your income in some cases. You may not actually be able to get anything but an unsecured guarantor loan if your personal circumstances are bad enough.

But, if you are uncomfortable getting a loan with a co-signer or you simply don’t know anyone that could do this, it may not be a possibility. If you have a late repayment, it will not be good for the guarantor on your loan! You may want to avoid borrowing in these circumstances.

If either option is possible, you might want go with the one that has a better loan term and better interest rate to save money. Just figure out what matters to you more, a better interest rate or not having to include another person on your loan.

You might be able to try different lenders as well to find the best deal for you.

How Can I Improve My Chances of Getting a No-Guarantor Loan?

To improve your chances, or even just to get a better loan term, here are some things to do.

Boost your credit score by making on-time payments and paying down large debt loads if possible. You can also download a credit building app like Ava. Or, if you need serious credit repair, try one of these best credit repair companies.

You can also improve your credit rating by buying tradelines from tradeline companies like Tradeline Supply Company. This will help you get a better interest rate as well.

Conclusion

With careful planning and responsible use, no guarantor loans can provide a valuable boost when you need it most.

Whether you’re dealing with a financial emergency or working towards a better financial future, these loans can provide the assistance you need without the need for a guarantor.

They can provide a stepping stone towards financial independence, giving you the freedom to handle your financial affairs on your own terms.

In conclusion, no guarantor loans can serve as a viable solution for individuals seeking financial independence.

It provides an opportunity to receive the funds you need without tying your financial health to someone else’s.

As with any financial decision, it’s imperative to proceed with caution, ensure you fully understand the terms and conditions, and take steps to manage the loan responsibly.

Next Smart Money Posts:

How to Start Preparing for Retirement Based on Your Age

A Penny Saved is a Penny Earned

How to Save Money From Your Salary

Financial Planning for Students

$15 an Hour is How Much a Year?

How Much is $18 an Hour Annually?

7 Ways to Save Money when You Eat Out

How Much is $20 an hour a Year?