This post may contain affiliate links. Please read my disclosure for more information.

Velocity banking is a strategy for paying off your mortgage faster. It is that simple!

Imagine using a home equity line of credit, which is almost like a low-interest rate credit card, to chunk down your mortgage principal significantly.

You do this instead of making the usual small payments, and over time, it can reduce the total mortgage interest you pay substantially.

Now, you might be wondering how exactly you turn a line of credit into a turbo-charged debt-paying tool.

Well, it’s about rethinking the way you handle your money, like using the credit line as your checking account.

This means your income goes into the HELOC, reducing the balance—and since mortgage interest is calculated daily, you pay less over time.

But it’s not all smooth sailing; managing your cash flow is key, and you need to keep an eye on potential risks, such as variable interest rates that can change your repayment game.

And in this day and age of high interest rates on everything including HELOCS, the velocity banking strategy may not actually be the best tactic.

What is Velocity Banking?

Velocity banking might sound like some kind of race car term or scientific strategy. But it is actually a strategy designed to help you tackle debt more quickly. It is one of a few ways of beating the banks!

In most cases it is used to pay down a home mortgage early, thereby saving a lot of money in interest by shaving years off the loan.

In most cases people use the power of a Home Equity Line of Credit (HELOC) to reduce interest payments and accelerate mortgage payoff.

Check out these books on financial freedom.

Earn Interest on Your Money

CIT Bank: Make money while you sleep with a high yield savings account. *

*For complete list of account details and fees, see our Personal Account disclosures

Principles of Velocity Banking

The core idea behind velocity banking is using your home’s equity cash value to your advantage.

Essentially, you borrow against the equity in your home with a HELOC, which typically has a lower interest rate than a traditional loan or credit card.

By doing this, you’re aiming to pay off your debt in large chunks rather than just chipping away at it slowly over time.

- Equity: This is the portion of your home that you actually own — think of it as your stake in the property. The greater your equity, the more you can potentially borrow with a HELOC.

- HELOC: It’s a revolving credit line, which means you can borrow from it, pay it back, and borrow again up to a certain limit.

- Credit Score: Your credit score matters here because it affects the terms of your HELOC. A higher score can snag you a better interest rate.

Related reading:

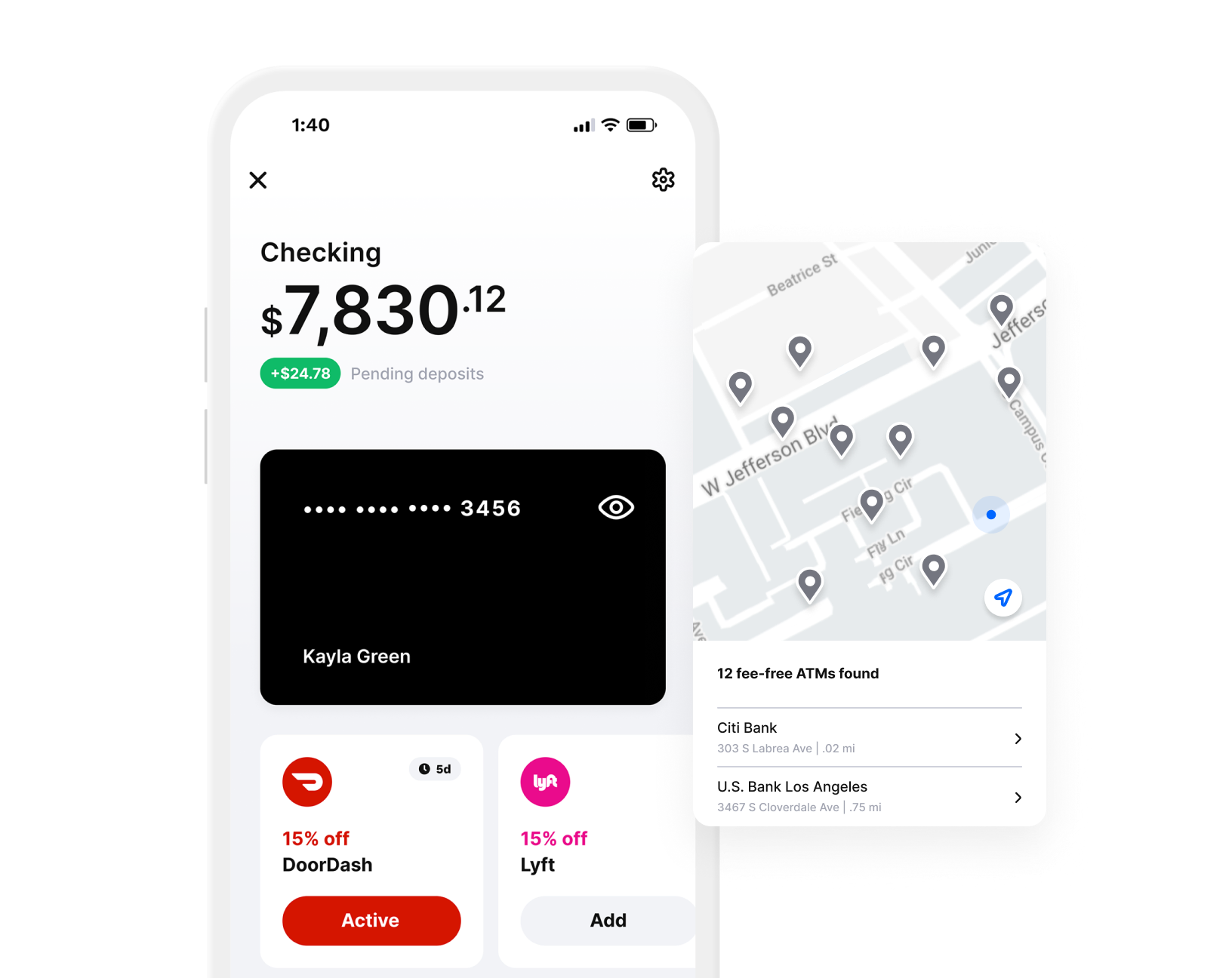

Albert Banking & Money App

Get up to $1,000 Instantly!

Albert: The only all-in-one banking and money app you need. Automatic saving and investing. 20% cash back on purchases and more!

How Does Velocity Banking Work?

You start by securing a HELOC and using it to pay a sizeable portion of your mortgage principal.

Then, you funnel as much of your income as you can into the HELOC and only take out what’s necessary for other living expenses.

This decreases the principal balance, on which the interest is calculated, reducing the amount of interest you’d pay over time.

- Get a HELOC based on your available home equity.

- Pay down a large portion of your mortgage with the HELOC funds.

- Deposit your income into the HELOC.

- Withdraw your living expenses while the remaining balance reduces the principal.

- Repeat the process to continuously decrease the interest paid on your home loan and pay off the mortgage faster.

Remember, the effectiveness of the velocity banking process depends on discipline and a consistent income stream that exceeds your expense. This gives you the ability to make substantial payments towards the HELOC balance.

You always want to still make sure you have an emergency fund and positive monthly cash flow each month. Maintaining a savings account at all times for emergencies is important.

And, right now with even HELOC interest rates higher, it may not be the best strategy like it used to be. Sometimes just making an extra monthly payment each year is a simple but effective strategy.

Set Your Savings and Investments to Automatic with Acorns

Download the Acorns app, link it to your bank account and earn money while you sleep!

Acorns rounds up your spare change and moves it into an investment account for you. Download today and get a $5 bonus!

Tools for Velocity Banking

When using the velocity banking strategy, you’re going to use certain financial tools to help manage your debt.

Key tools include lines of credit like a HELOC and sometimes, credit cards. Each has its unique benefits for speeding up mortgage payoff and reducing interest payments.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit, commonly known as HELOC, is a revolving line of credit secured by the equity in your home. Here’s how it works for velocity banking:

- Loan Amount: Varies based on your home equity cash value.

- Interest Rates: Generally lower compared to other credit sources, saving you on interest payments.

- Repayment: Flexible, with the option to pay interest only or repay the principal at a pace that suits your finances.

Using a HELOC, you can make large lump-sum payments towards your mortgage principal, which can dramatically reduce the amount of interest you’ll pay over the life of your mortgage and possibly shorten the loan term.

Credit Cards

Credit Cards can also be used in velocity banking, although less commonly due to higher interest rates. However, if used smartly, they can offer some advantages:

- Rewards: Cash back or points that can indirectly reduce the cost of mortgage payments.

- Interest-Free Periods: Some cards offer 0% APR periods which can be advantageous for short-term borrowing.

Using credit cards requires discipline to avoid compounding your debt. Make sure that you’re able to pay off the credit card balances within interest-free periods or low-interest phases to prevent escalating your overall costs.

To use these in this strategy, you could also take cash off the cards with a special 0% apr offer and use it for a lump sum mortgage payment.

Using Velocity Banking

Before diving into velocity banking, grasp the essentials: it’s all about smart cash flow management and cutting down on the interest you pay.

It’s a strategy that can shake up the usual way you handle your debt.

Strategic Payments and Cash Flow Management

To get rolling with velocity banking, track your cash flow meticulously. Here’s the play:

- Identify the extra mortgage payment amount you can safely divert from your income to tackle your mortgage payments.

- Then, use a HELOC or interest free credit card as your primary checking account for both income and expenses.

By doing so, the money you’re not using every month for living expenses temporarily reduces your mortgage balance.

Interest Reduction Techniques

Your focus here is to slash interest payments, right? Cool. Let’s keep it straight:

- You’ll make larger payments towards your monthly mortgage payment, smashing down the principal faster.

- The interest saved from these extra payments gets looped back into your debt payoff.

Remember, financial discipline is key. Stick to the script and watch your mortgage shrink faster than expected.

Make the Most of Your Money

Empower: Get the money management tool to help you control your personal finances. Net worth, future plans, savings planner, and investments, all in one award-winning dashboard.

Benefits and Risks

When thinking about doing velocity banking, you’re probably wondering about the rewards and what could go sideways.

It’s all about understanding how to use your cash flow to save on interest and potentially hasten your journey to financial freedom.

But there’s a balance—weighing those benefits against the risks that come with a strategy that’s not one-size-fits-all.

And right now, with interest rates high it may not be the most advantageous time to use this financial strategy.

Advantages of Velocity Banking

- Interest Savings: You’ll potentially save thousands in interest. By using a credit to pay down your mortgage in larger chunks, you pay less interest over the loan’s life because you shorten the length of the loan.

- Financial Freedom: This strategy might fast-track the payoff time for your mortgage and other debts, getting you closer to that sweet spot of financial freedom.

- Increased Cash Flow: As you pay down your mortgage balance, your line of credit frees up, which can increase your available casheach month.

- Potential Tax Benefits: Depending on your financial setup, you may find some tax advantages when using a HELOC for this strategy, though it’s always important to consult a tax professional.

Potential Downsides and Risks

- Risk Tolerance: Your comfort with financial risk needs to be high. If the idea of leveraging debt against your home gives you the sweats, this might not be your jam. You need to make sure you have positive cash flow each month.

- Emergencies: You need a solid plan for emergencies. Losing your income with a HELOC hanging overhead could lead to trouble.

- Requires Discipline: It’s not a set-and-forget strategy; it demands rigorous financial discipline and staying on top of your monthly cash flow.

- Fluctuating Interest Rates: Since HELOCs typically have variable interest rates, you could get stung if rates rise, potentially offsetting some of the interest savings you’re aiming for.

Alternatives to Velocity Banking Strategy

There are other financial strategies that might be better to use to pay off your mortgage early.

Infinite Banking vs. Velocity Banking

On the other hand, Infinite Banking revolves around whole life insurance policies as a financial tool to pay off debt, including your mortgage.

By borrowing against your life insurance policy, you essentially become your own bank. This method can offer flexibility and potentially earn dividends, which may offset the interest you pay on the borrowed amount.

The infinite banking concept is designed to keep the capital within your control, as opposed to paying interest to banks.

Making Extra or Higher Payments

Another option to pay down your mortgage early and save on interest is simply to make higher monthly mortgage payments or extra payments.

When you make an extra payment, it changes the amortization on your loan, reducing the amount of years needed to pay off your mortgage. And thereby, reducing how much interest you pay.

In this day and age of such high rates, this may actually be a better choice for you than velocity banking. You will need to make sure you have enough positive cash flow to do this.

Tips for Using the Velocity Banking Strategy

When you dive into velocity banking, you’re committing to a strategic method for paying off your mortgage or even consolidating debts.

It’s about smartly using debt to clear debt, requiring a fine-tuned balance of discipline and budget management.

Discipline and Budget Management

To truly make the velocity banking strategy work for you, start with a solid budget. Identify your monthly income and expenses, then determine how much you can allocate to pay down your mortgage using a HELOC.

Avoid overspending; any slip-up can jeopardize the entire strategy. It’s not just about following a plan, it’s about sticking to it with financial discipline.

Monitoring and Adjusting

With your budget in place, keep an eye on your finances like a hawk. Review your spending and the balance on your HELOC monthly.

If you notice you’re nearing your credit limit or not reducing debt as expected, reassess and adjust your spending. Remember, velocity banking is dynamic; it demands constant vigilance and flexibility.

Working with Financial Professionals

Although velocity banking puts you at the helm, don’t underestimate the benefit of guidance from financial experts.

They can help you understand details like debt consolidation options and intricacies of your HELOC.

Velocity Banking in Different Financial Scenarios

The velocity banking strategy can reshape the way you handle debts and large expenses and isn’t just for your mortgage payment. It’s a strategy that uses your income to lower debt fast, but it’s not a one-size-fits-all solution.

Let’s break down how it might work in different aspects of your financial life.

Handling Large Expenses and Emergencies

When life throws you a curveball, like a hefty hospital bill or a sudden home repair, velocity banking can be a life-saver.

You park your paycheck in a HELOC, effectively making a lump sum payment on your mortgage. This reduces your mortgage principal balance quicker than traditional methods.

The twist? You also use this line for your regular expenses. Since a HELOC often has a lower interest rate compared to other types of loans, you’re minimizing interest expenses in the long term.

Just make sure your emergency funds or other savings can cover your HELOC payments, so your home’s not at risk.

Business Owners and Investors

If you’re an entrepreneur or investor, your cash flow can be unpredictable. Here’s where velocity banking might help you.

It allows you to use your business income or investment returns to chip away at your mortgage principal balance.

This can increase your home value to debt ratio, giving you more financial leeway. You can also apply this to other loans like student loans or for paying down business loans.

Instead of leaving your income sitting in a checking account, you reduce the principal—and hence, interest—much faster.

This strategy requires diligent financial management to ensure you’re not overextending. Remember, while the method can accelerate debt payment, it also demands discipline and a steady income stream to be effective.

Final Thoughts

While velocity banking may not be the best plan in this current high interest environment, the principles are still sound!

You can use 0% apr credit cards to do the same thing, or make extra payments. The point is you can work to pay your mortgage off more quickly and save yourself thousands!

Frequently Asked Questions

You use a line of credit to pay down the principal of a mortgage or other loan, then repay the line of credit itself. This helps you reduce interest and the repayment period of your mortgage.

Be careful to not over-leverage your finances and not leave enough liquid cash for emergencies. Missteps can lead to increased debt rather than savings.

Imagine you have a mortgage and a HELOC. You’d use the HELOC to pay a chunk of the mortgage upfront, then pay off the HELOC, which often has a lower interest rate. This means you accelerate your mortgage payoff, saving on interest over time.

Velocity banking focuses on reducing interest and leveraging credit lines. However, the debt snowball method involves paying off debts from smallest to largest, gaining momentum as each balance is paid off. Your choice depends on your financial situation and preferences.

Treat credit cards like credit line in the velocity banking strategy, using them to cover expenses while your income pays down debt. Always track carefully to prevent overspending. And just use credit cards with 0% APR to make this work.

Yes, similar to managing a mortgage, you can use other credit or loans with lower interest to pay off your credit card debt in larger chunks. It can help reduce costs and the payoff timeline.