This post may contain affiliate links. Please read my disclosure for more information.

Are you trying to create a budget but struggling to differentiate between your needs and wants? It can be challenging to determine which expenses are necessary for your basic survival and which are just luxuries.

However, understanding the difference between needs and wants is crucial when creating a budget that works for you.

Needs are the essential items that you need to survive, such as food, shelter, and clothing. These are the expenses that you cannot live without, and they should always be your top priority when creating a budget.

On the other hand, wants are the things that you desire but can live without, such as entertainment, dining out, and luxury items. While these things can certainly make life more enjoyable, they are not essential for your survival.

When creating a budget, it’s important to understand needs and wants examples so that you can prioritize your spending accordingly. Let’s get more in-depth with examples of wants and needs!

Definition of Needs and Wants

Wants and needs in general are things that drive human behavior. Understanding the difference between the two can help you make better decisions.

According to Abraham Maslow’s Heirarchy of Needs, there are 5 categories of human needs. Physiological, safety, love and belonging, esteem and self-actualization are the 5 categories.

And, when it comes to budgeting, it’s important to understand the difference between needs and wants and examples of each.

Most budgeting methods includes wants and needs as part of how you allocate your money.

What are Needs?

Needs are essential expenses that you must have to survive and maintain a basic standard of living, like food for example.

While Maslow’s theory includes things like safety, self actualization and love and esteem, for budgeting purposes we are talking about the physiological need examples like food and shelter.

Wants are things that you desire but are not necessary for survival, like Netflix or vacations. One way to tell the difference is to see whether the absence of something would cause harm.

For example, if you lost your home, it would cause a great deal of harm and without a roof over your head you are not safe. In contrast, if someone stole your Fendi purse, you will survive! (Albeit with some sadness.)

Some examples of needs include:

- Housing: Rent or mortgage payments, property taxes, and home insurance.

- Food: Groceries and other essential items like toiletries and cleaning supplies.

- Utilities: Gas, electricity, water, and internet.

- Transportation: Car payments, gas, insurance, and public transportation costs.

- Healthcare: Doctor visits, prescription medications, and health insurance premiums.

What are Wants?

Wants are things you might spend your money on that are not a necessity to live. Common needs vs wants are food vs buying the latest technology.

So while food is a need you must have, eating out at an expensive restaurant or buying high end purses are wants.

Examples of wants include:

- Entertainment: Streaming services, video games, and concert tickets.

- Dining out: Restaurants, cafes, and fast-food chains.

- Travel: Vacations, weekend getaways, and road trips.

- Luxury items: Designer clothes, jewelry, and high-end electronics.

- Hobbies: Gym memberships, sports equipment, and craft supplies.

It’s important to prioritize your needs over your wants when creating a budget. Start by identifying your essential expenses and allocating a portion of your income to cover them. Then, you can allocate any remaining funds to your wants.

By focusing on your needs first, you can ensure that your basic survival needs are met before allocating funds towards your wants.

This can help you avoid overspending and ensure that you have enough money to cover your essential expenses.

Remember, needs are different from wants because they are essential for your survival and basic needs, while wants are things that you desire but are not necessary for survival.

Prioritizing your needs and wants is crucial to achieving your financial goals. Start by identifying your goals, listing your needs and wants, and allocating your money accordingly.

Remember to prioritize your needs first, and then your wants based on your values and financial goals. When shopping, use cashback apps like Rakuten and Ibotta to save money!

More reading:

- How to Save $5,000 with the Nickel Challenge

- 9 Cash Envelope Categories

- Why Can’t I Save Money?

- How to Save $3,000 in 3 Months

Cut Your Monthly Expenses in a Hurry

BillTrim: Let this bill negotiation service cut your monthly expenses. It will monitor and pay your bills for you!

Consumer Cellular provides the same cell service as the big guys but with no contract, no activation fee and you can keep your phone number when you switch!

Examples of Wants and Needs

If you want your budgeting to be correct, here is an in-depth list needs vs. wants examples to help you place your expenses in the right budgeting category.

This is helpful if you are using the envelope system for tracking your spending.

Examples of Needs in a Budget

When it comes to managing your finances, it’s important to identify your wants vs needs. Needs are the essential expenses that you must pay to maintain your basic quality of life. They are your basic necessities Here are some examples of needs in a budget:

Shelter (Rent or Mortgage)

Your housing expenses are one of the most significant needs and essential things in your finances. Whether you rent or own, you need a place to live. Your rent or mortgage payment should be a top priority and are an example of a need.

Groceries

Food is another example of a essential need in your budget. You need to eat to survive, so you must allocate a portion of your income to groceries.

When shopping for groceries, focus on buying nutritious foods that will keep you healthy. Keep in mind however that dining out would be an example of a want, not a need.

You can save a lot of money by eating in. Here are some frugal grocery shopping tips to help you save more.

Utilities

Utilities such as electricity, gas, water, and internet are examples of essential needs. You need electricity to power your home, gas to heat it, water to drink and bathe, and internet to stay connected. Essential things like utilities must be paid.

Transportation Expenses

If you need a car to get to work or school, then transportation expenses are a need category. This includes car payments, gas, insurance, and maintenance costs.

However, if you live near a bus line you can consider this type of transportation instead of buying a car.

Health Care

Health care expenses are a need in your budget. You need to pay for medical care, including doctor visits, prescriptions, and health insurance premiums.

Child Care

If you have children, then child care expenses are a need in your budget. Whether you pay for daycare or hire a nanny, child care is an essential expense, especially if you are working full time.

Insurance Premiums

Insurance premiums are another need in your budget. You need insurance to protect yourself and your assets. This includes car insurance, health insurance, and home insurance.

Overall, identifying your needs in your budget is crucial for financial stability.

By prioritizing your needs, you can ensure that you have enough money to cover your essential expenses and still have some left over for your wants.

Earn Interest on Your Money

CIT Bank: Make money while you sleep with a high yield savings account.

Examples of Wants in a Budget

When it comes to budgeting, it can be difficult to differentiate between needs and wants. Wants are things that you desire but are not essential to your survival or well-being.

Here are some examples of wants that you may want to consider:

Fancy cars

While a car is a necessity for many people, a luxury car is not. If you’re on a tight budget, consider purchasing a more affordable car or even using public transportation. Or downsize your current automobile to something cheaper.

Vacations

While vacations can be a great way to relax and unwind, they are not a necessity. If you are trying to watch your budget, consider taking a staycation or a shorter trip closer to home.

Dining Out

While it’s nice to eat out at restaurants, it can be expensive. Making your own food at home will keep your budget down.

Cook at home more often or find cheaper places to eat out when you do. Definitely take your lunch to work as this will add up to a lot of dollars if not!

Gym Memberships

While exercise is important for your health, a gym membership is not necessary. To save money, think about working out at home or finding free exercise classes in your community. Staying healthy should be a priority in your life though!

Streaming

While streaming services like Netflix and Hulu are convenient, they are not essential. Think about canceling your subscriptions or sharing them with friends or family. You can also sign up for 1-2 months when they have a really great deal and then cancel.

Latest Technology

It may be tempting to buy the latest iPhone or tablet but new technology is not a must-have. Neither are new tvs, laptops or other electronics so don’t spend on items like these.

Designer Clothing

While designer clothing can be fashionable, it is not necessary. If you need to watch your spending, consider purchasing more affordable clothing or shopping at thrift stores.

Spa Treatments

You can definitely survive without a facial so this category is an example of a want and not a need.

New Furniture

If you are thinking about buying new furniture but trying to stick to a budget then don’t! As long as you have something functional to sit on you don’t need new furniture.

Jewelry and Accessories

Jewelry and new accessories like purses and shoes are not a necessity but are examples of wants.

Remember, wants are not essential to your survival or well-being. While it’s okay to indulge in wants from time to time, it’s important to prioritize your needs and make sure they are covered in your spending first.

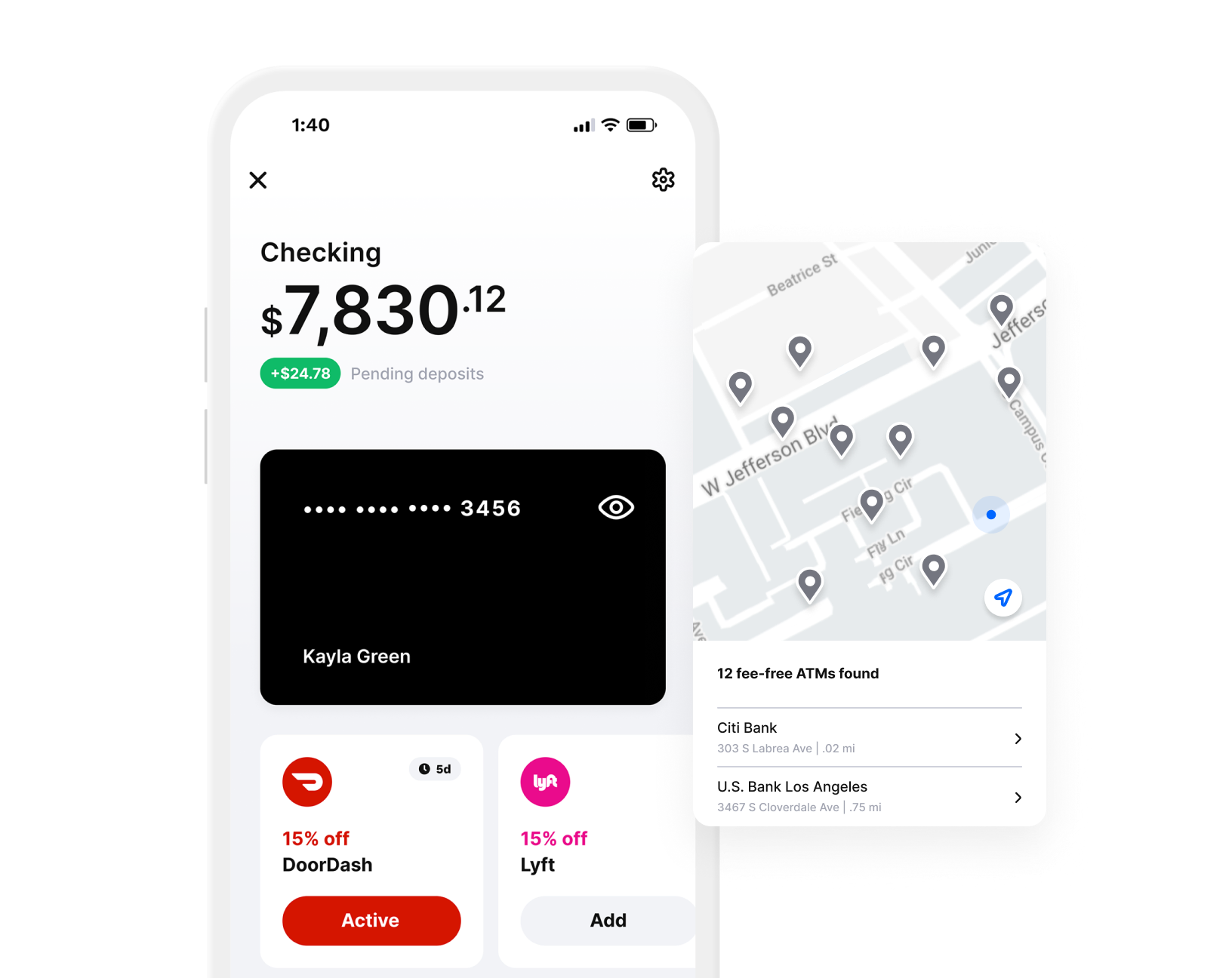

Albert Banking & Money App

Get up to $1,000 Instantly!

Albert: The only all-in-one banking and money app you need. Automatic saving and investing. 20% cash back on purchases and more!

Budgeting Strategies

When it comes to budgeting, it’s important to have a plan that works for you and your financial situation. Here are a few budgeting strategies to consider:

50/30/20 Budget

The 50/30/20 budget is a popular budgeting strategy that involves dividing your income into three categories: needs, wants, and savings.

With this budget, you allocate 50% of your income towards needs (such as housing, transportation, and food), 30% towards wants (such as entertainment and dining out)

The remaining 20% goes towards savings (such as retirement funds and emergency funds). You can spread the 20% out across different sinking funds categories if you want.

Check out the advantages and disadvantages of budgeting.

Zero-Based Budget

A zero-based budget is a budgeting strategy that involves allocating every dollar of your income towards a specific expense or savings category.

With this budgeting strategy, you start with your income and subtract all of your expenses until you reach zero. This helps you prioritize your spending and ensures that every dollar has a purpose.

Other popular budgeting Methods:

Get up to $1,000 Instantly!

Is Saving a Want or a Need?

It is a common question about where saving money falls into the realm of budgeting categories and a want vs need.

In most budgeting methods, saving is its own category, separate from needs and wants and a category you need to contribute to regularly.

It really isn’t a need since you can survive without it. However, if you want to meet your financial goals and have a healthy future, you should be saving money so it should be high priority.

You can easily automate your savings with an app like Acorns.

If you have debt for instance, it can cause a lot of damage to your finances and the stress is bad for your mental health! So, it’s important to make debt repayment a priority in your budget.

Part of saving money should include retirement funds like a 401k and above all you should make sure you have an emergency fund for unexpected expenses. Try to have at least 3-6 months of income in your emergency fund.

Make sure you are saving in a high yield interest account like CIT Bank offers.

Frequently Asked Questions

What are some common examples of needs in a budget?

Needs are the essential expenses that you must pay for to survive and maintain a basic standard of living.

Some common examples of needs in a budget include housing, food, utilities, transportation, healthcare, and insurance. These expenses are necessary for your physical and mental well-being.

What are some common examples of wants in a budget?

Wants are the non-essential expenses that you can live without, but they make your life more enjoyable and comfortable.

Some common examples of wants in a budget include dining out, entertainment, hobbies, vacations, and luxury items. These expenses are not necessary for your survival, but they can enhance your quality of life.

How do you differentiate between needs and wants in budgeting?

To differentiate between needs and wants in budgeting, you need to evaluate each expense and determine whether it is essential or non-essential.

Needs are the expenses that you must pay for to survive and maintain a basic standard of living, while wants are the expenses that you can live without. You can use a needs vs. wants worksheet to help you differentiate between the two.

What are some strategies for prioritizing needs and wants in a budget?

One strategy for prioritizing needs and wants in a budget is to focus on your needs first and then allocate the remaining funds to your wants. Another strategy is to set a limit on your wants and prioritize the ones that are most important to you.

You can also use the 50/30/20 rule, where 50% of your income goes to needs, 30% goes to wants, and 20% goes to savings and debt repayment.

What are some common mistakes people make when budgeting for needs and wants?

One common mistake people make when budgeting for needs and wants is not differentiating between the two and overspending on wants. Another mistake is not accounting for unexpected expenses, such as car repairs or medical bills. People also tend to underestimate their expenses and overestimate their income, leading to a budget deficit.

How can tracking your spending help you identify your needs and wants in a budget?

Tracking your spending can help you identify your needs and wants in a budget by allowing you to see where your money is going.

You can use a printed budgeting sheet to track your expenses and categorize them as needs or wants. This can help you identify areas where you can cut back on non-essential expenses and prioritize your needs.

Final Thoughts on Wants and Needs Examples

Now that you have some examples of needs and wants, you can stick to your budget with ease! Remember that while it may take some sacrifices along the way, budgeting and taking control of your finances can change your future and get you the financial freedom you want!

Next Smart Money Posts:

How to Prepare for Retirement Based on Your Age

How Much is $20 an hour a Year?

7 Tips for Guilt Free Shopping

40 Cheapest Foods to Buy when You’re Broke

How Much is $18 an Hour Annually?

7 Ways to Save Money when You Eat Out