This post may contain affiliate links. Please read my disclosure for more information.

Are you struggling to get approved for credit due to a poor credit score? If so, you’re not alone.

Many people face challenges when it comes to getting credit, especially those with bad credit. And, they also struggle to make purchases as a result.

Fortunately, there are options available to help you get the items you need without having to pay for them upfront. One of these options are buy now pay later catalogues.

Buy now pay later catalogues allow you to purchase items and pay for them over time, usually in monthly installments.

Many online catalogues for people with poor credit will extend you the option to pay over time. Some even have a no credit check program!

Some of the most popular buy now pay later catalogues for bad credit include Big Lots, Conn’s Home Plus, and even Amazon.

Let’s be honest: unexpected bills can wreak havoc on your budget. Car on the fritz? Fridge kicking the bucket? It happens to the best of us. Don’t let a poor credit score make you think you’re stuck waiting.

Buy Now, Pay Later (BNPL) catalogs come riding in like a knight in shining armor, letting you grab what you need and spread out the cost into bite-sized chunks.

Before you apply for a buy now pay later catalogue, it’s important to understand how they work and the terms and conditions associated with them.

While they can be a great way to get the items you need without having to pay for them upfront, they can also come with high interest rates and fees.

With that said, if you use them responsibly, buy now pay later catalogues can be a helpful tool for managing your finances and getting the items you need now.

How Does Buy Now Pay Later Work?

Buy Now Pay Later is a type of credit that allows you to purchase items and pay for them at a later date.

You can buy items and spread the cost over a period of time with monthly payments. This type of credit is offered by catalogs and online retailers.

A buy now pay later payment plan, which is also known as a BNPL, will let you get what you need upfront but pay with an installment loan from the seller over time.

When you apply for a Buy Now Pay Later catalogue, the company will usually check your credit history.

However, they are often more lenient than traditional lenders, and you may be approved even if your credit is not good.

In addition, there are some online catalogs that will offer you instant approval without a credit check.

Looking for a Quick Way to Earn Extra Money Online? Try These:

Branded Surveys: Make money fast for simple surveys. Try this super easy way to earn real money from a trusted source. $10 sign up bonus!

Chat Assistant: Get paid to work from home? Yes please! This online job starts at $30 per hour. Work as a live chat customer support assistant! Click here to start!

What is a Buy Now Pay Later Catalog?

If you have poor credit, you may think that buying items on credit is not an option for you. However, Buy Now Pay Later catalogs may be a solution.

Catalogues are a type of retailer that allows you to shop for items from the comfort of your own home. Catalogs offer a range of products, from clothing and electronics to furniture and appliances.

When you shop with at a buy now pay later catalogue with a bad credit score, you can choose to pay for your items upfront or spread the cost over a period of time but still get the items right away.

You will just have to make regular monthly payments and in some cases may need to make an upfront down payment.

However, it is important to remember that Buy Now Pay Later is a form of credit and should be used responsibly. If you miss payments or fail to pay off your balance, you may incur fees and damage your credit score.

Buy Now Pay Later catalogues can be a great option for people with bad credit who need to purchase items but can’t get approved for traditional credit.

You will have to be at least 18 years old and have a valid U.S. bank account. And of course, certain BNPL catalogues may be stricter about who they offer payment plans to.

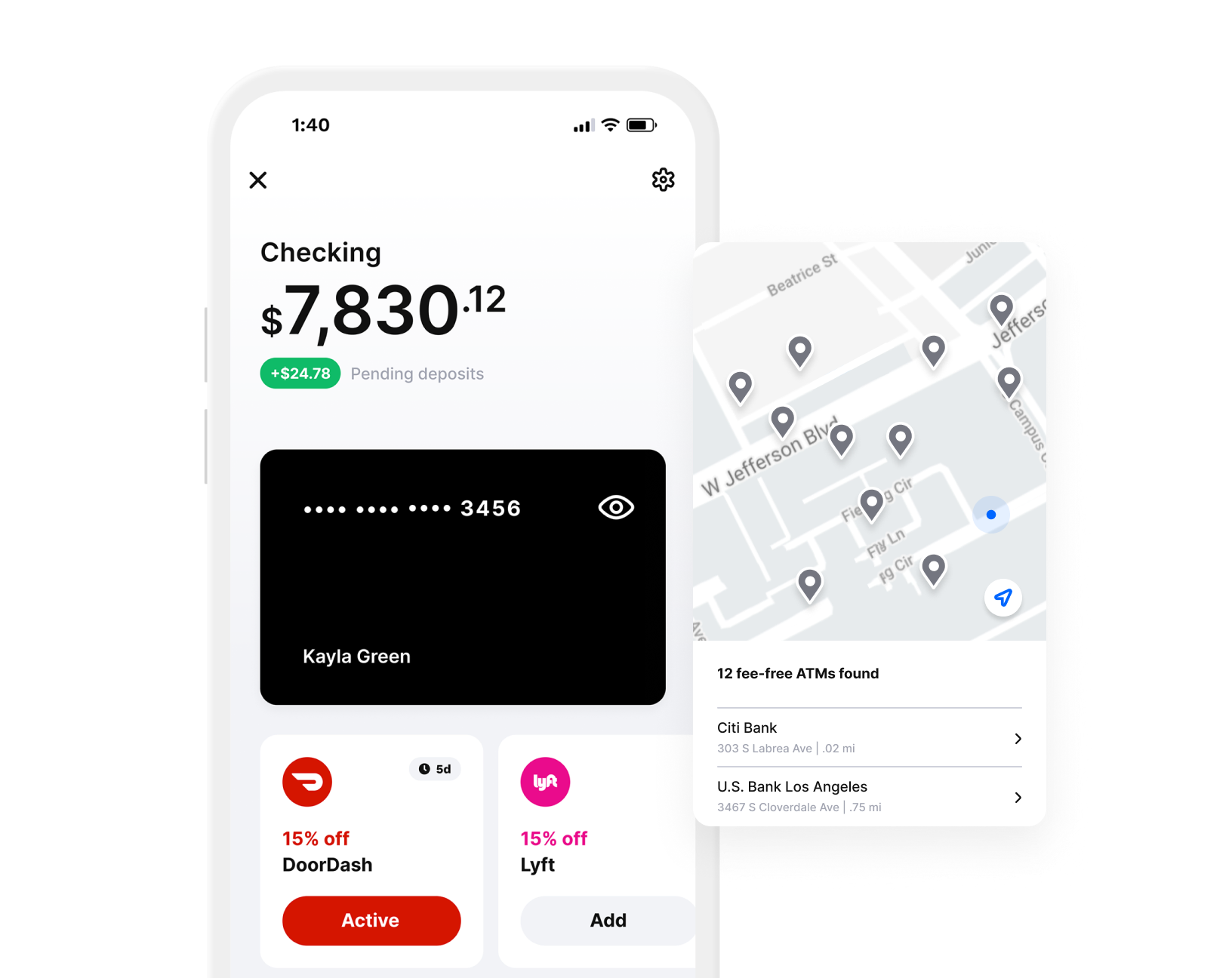

Need to Build Your Credit Fast? Try Ava!

Ava: You can get a line of credit fast with the Ava app. Plus, it can help boost your credit score quickly! Download the app!

And, Download Credit Karma for easy score tracking!

25 Buy Now Pay Later Catalogs for People With Bad Credit

If you are looking for a buy now pay later payment plan and you have a low credit score, here are some online catalogue options!

You can get what you need now with low monthly payments.

1. Amazon

Believe it or not, Amazon offers buy now pay later payment plans! Which is awesome since Amazon has pretty much any item you might want or need.

When you are ready to check out, you can choose an option for monthly payments. Your order must be over $50 in total and there are a few items that you cannot choose to do an installment loan for.

There are no annual fees either!

Our Favorite Cash Back App

Rakuten: Make cash back on all your online shopping. Get a $50 bonus!

2. MDG

The website of MDG states that they believe you should be able to buy things regardless of your credit history.

You can get set up on their site for their own consumer financing, even with a poor credit score. And, it will actually help your credit since they will report your payments to the 3 major credit bureaus.

You will have to pay a finance charge of course. But, you can buy many technology and home items on their site.

3. Montgomery Ward

Montgomery Ward has been around forever, as in 150 years! It’s a name I had forgotten about from my childhood, but you can actually shop Montgomery Ward’s online these days.

And, they offer a buy now, pay later option with their own line of credit. They give you flexible down payment and flexible monthly payment options with their store credit card.

If your credit is bad, this is a great option to buy things and improve your score at the same time.

You can buy just about anything you need for your home. Furniture, bed and bath items, cookware and even curtains.

Plus, you can purchase electronics, health and wellness products, clothing and even jewelry with Montgomery Wards credit card. Just apply for credit approval and make your first payment!

Related reading:

Albert Banking & Money App

Get up to $1,000 Instantly!

Albert: The only all-in-one banking and money app you need. Automatic saving and investing. 20% cash back on purchases and more!

5. Afterpay

At this point you have probably seen the word Afterpay with the logo pop up when you are paying for something online.

Afterpay is essential a company that offers you the option to make your purchase in a few monthly payments instead of all at once.

The nice thing about it is it is showing up as an option for purchases with all kinds of companies all over the internet.

They allow you to pay over time in 6 or 12 months with interest. Or, you can opt for just 4 monthly payments without interest. However, that may not be an option for you if your credit score is bad.

You can even use their service to pay for things in the actual retail store if it is one of their partners. And best of all, they are a no credit check instant approval option. So there won’t be credit checks dinging your score.

And they have a user-friendly app you can download and use to shop. Nike, Macy’s and Target are just a few of the brands that allow you to use Afterpay. And there are no hidden fees.

Our Top Credit Repair Service Company:

Sky Blue: Best overall value with an A+ BBB rating, free initial consultation and 90 day money back guarantee.

6. Fingerhut

Fingerhut actually says on their website that if you join their WebBank Fingerhut credit program it can help your credit to improve. And they can give you instant approval.

You can apply and get an instant decisions! And you can buy just about anything on their site. Electronics, jewelry, home decor, fitness, pet supplies, outdoor furniture and pretty much anything a huge department store would have. is available in their catalogue.

You can purchase items with a payment upfront as little as $30 down and then make monthly payments for the rest of the purchase price.

They even call their credit program “FreshStart” financing, meaning if you if have poor credit, it can help you get a fresh start. Be aware that they do have high interest rates at 29% APR.

7. Big Lots

When I was a kid in West Virginia we always wanted to go to the local Big Lots store. It was this big store with tons of different items, all at very reduced prices.

They still have a lot of brick and mortar stores but you can also buy from their online store. They sell household items, furniture, mattresses, toys and even beauty products.

Through Progressive Leasing that they have partnered with, you can opt for buy now pay later payment plans when you purchase anything.

And, even if you have a poor credit score they say you can get approved! And you can pay as little as $49 with their flexible down payment options.

8. ABT Electronics & Appliances

Another buy now pay later catalogue is ABT Electronics and Appliances. They use a company called Affirm that offers you the option on installment plans for payments.

Tons of electronics and home appliances are available for purchase.

9. Sear’s

Sear’s is another old school department store that has been around forever. They sell major appliances, electronics, power tools and even clothing.

And, they offer their own credit program that allows you to buy items and then pay for them over time. You just have to apply and get credit approval.

10. The Bradford Exchange

The Bradford Exchange is a collectibles catalogue. So it is more narrow in what you can purchase.

But, they offer interest free installments options on payment for most of their items. If you are looking for a place to shop for gifts for people, this is a great site for that.

They even offer personalization on the gifts you purchase and they have been in business for 50 years so they are a legitimate site to buy from. And well-known in the world of catalogues for bad creditors.

When you checkout, you will see the installment plan payment options which will show the monthly amount and number of payments required.

11. Overstock

Overstock is a fantastic place to shop. They offer a lot of great sales and discounts routinely. And, pretty much any furniture or home decor you might want is available on their site. Even electronics and pet supplies.

But, did you know they are also a catalogue for people with bad credit? They have a lease to own program through Progressive Leasing that allows you to buy now but pay later.

And, they also now own Bed, Bath & Beyond which you can leverage the Progressive Leasing program on to purchase items.

Of course you have to be 18 years or older to qualify. You pay a down payment and then a specified amount of monthly payment until the balance is paid in full.

There aren’t any interest charges or annual fees and it is ideal for someone with bad credit who wants to buy things since it is technically lease-to-own. However, they do charge a substantial fee on top of the purchase price to leverage the leasing payment option.

Cut Your Cell Phone Bill by More than Half!

Consumer Cellular provides the same cell service as the big guys but with no contract, no activation fee and you can keep your phone number when you switch!

12. Wayfair

Another site I love to buy from is Wayfair. They have a ton of items to shop for. I’ve even bought a couch from their website and it was perfect!

They offer tons of home decor items, furnishings including rugs, wall art and furniture for every room of the house. And, Wayfair is one of the catalogues with finance options.

But, they also have a program called Wayfair Financing for people with any type of credit, even bad credit.

They work with several different partners which helps them serve people with different levels of credit. You can check your eligibility without your credit score being affected

Once you apply, you may get more than one offer that you can choose from.

13. Stoneberry

Stoneberry is an online store that sells just about anything and everything. Here are some of the categories you can purchase from:

- Furniture

- Outdoor equipment and tools

- Electronics

- Kids and toys

- Health and beauty

- Jewelry

- Clothing

- Sporting goods

You can shop online now, pay later with Stoneberry Credit. This program also works for Masseys®, Mason Easy-Pay® and K. Jordan which are part of the Stoneberry catalogue and can be shopped from the same website.

The interest charge however is high at 29%.

14. Boscov’s

Another online retailer with a huge catalogue of items is Boscov’s. Clothing, accessories, appliances, home decor and even items for kids are available to shop.

They also have their own credit program that you can apply for to shop for things but not pay all at once. They do require you have a credit score of at least 640, but are known to be easy to get accepted for.

They do not require a down payment when you purchase either, just a verifiable bank account.

15. Flexshopper

Flexshopper is a huge website where you can buy things in a lease-to-own program. Buy now, pay later is actually what their company is built around. When it comes to catalogues with finance, this is a great place to start.

You actually apply for their credit program before you even start shopping! They cater to people who do not have credit or have poor credit.

You can purchase the items you need, but pay later and over time to make it more manageable.

The spending limit is $2,500 but you can have up to a year to pay off your bill. If you don’t have the cash today to buy something, you can shop at Flexshopper.

They have tons of available products and categories. Electronics, cell phones, computers, jewelry and mattresses are only some of the available items.

Plus, they offer major brands like Apple and Samsung.

16. Country Door

If you like farmhouse decor, you might want to shop at Country Door. And even better, if you have poor credit it is a great place to shop.

The Country Door Credit Program is built to help you build your credit score and positive history. Which makes it an ideal catalogue for bad creditors.

Because they are the ones in charge of the credit program, it is easier to qualify and even in some cases get instant approval. And, you can get minimum monthly payments as low as $20.

17. Seventh Avenue

Seventh Avenue is another online buy now, pay later catalogue you can use if you have poor credit.

They offer their own line of credit to give you payment plan options. If you have a lower credit score, you may be able to provide a small down payment and still get a payment plan to pay your order off in full.

You can choose monthly installments as low as $20, but the interest rate can be as high as 25.99%. The tradeoff for the low monthly payments is the high apr.

It is a great resource however as you can purchase just about anything you might need. Home items, bed & bath, furniture, electronics, outdoor, gifts and toys. You can even buy now pay later for clothing.

18. Conn’s Home Plus

Conn’s Home Plus offers their own line of credit to pay for your purchases. You can buy appliances, furniture, tvs, computers, bedding and even fitness items.

And they offer more than one way to purchase and pay later or over time. You can use their financing program whether you have good credit or are working to build it back up. They may have the most flexible payment plans from our list.

Or, you can sign up for a Conn’s Home Plus credit card that is provided by the third party Synchrony bank.

In addition, they also offer lease-to-own payment plans and even layaway which is where you receive your item once you’ve made all the required monthly payments without interest fees.

You don’t even need credit at all to use the layaway program! You can enjoy interest free payments and instant approval for the lease to own option. Just make your first payment to reserve the item.

19. Zebit

Zebit has an online instant credit catalogue with tons of items to purchase. Electronics including Apple products, kitchenware, jewelry and home decor and furnishings.

If you can’t afford something now, they offer you the option to pay for something over 6 months. And, they cater to people with less than perfect credit. Plus there are no interest fees.

They do not require a FICO score and credit checks to qualify for a payment plan in some cases. And you can as they say have “less than stellar credit” and still qualify.

Down payments at checkout are required and they have a catalogue credit limit of $1,500.

20. QVC

QVC is a widely recognized home shopping network. You can actually even pay over the phone.

Their home shopping online catalogue provides instant credit approval options. Plus, they offer tons of inventory. Fashion, beauty, jewelry, accessories, health & fitness and shoes are just some of the items available for discounted prices.

They have a fast approval process for their online catalog and flexible payments, even if you have a bad credit score.

Earn Interest on Your Money

CIT Bank: Make money while you sleep with a high yield savings account.

21. Home Shopping Network

Another shopping network, HSN has FlexPay. With no down payment, you can buy now pay later electronics and home goods with no interest or fees.

FlexPay is a type of layaway so this is one of the best buy now pay later catalogs with no credit check.

Buy Now Pay Later Services You Can Use (Almost) Anywhere

There are actually several BNPL services and apps now that you can use across many online catalogues and websites. These apps and services greatly increase the number of buy now pay later catalogs instant approval that you can use.

We mentioned AfterPay already, but here are a few more:

22. Sezzle

Sezzle is another company that will help you build credit while purchasing what you need now. It is an app that will split your purchase into 4 payments spread out over 6 weeks.

There are zero interest fees and your credit score can go up if you make all your payments on time. Best of all, Sezzle is accepted anywhere Visa is!

If you download the app, you can use it anywhere. You will need to make a 25% down payment.

23. Klarna

Klarna offers a few payment options including pay in 4 and even actual financing if you prefer longer terms. You can get what you need an make low monthly payments. Plus, they don’t require credit checks.

24. Quadpay

Another BNPL service is Quadpay. They also offer a four-payment method and plan. You can also choose to make payments weekly or even bi-weekly if you prefer a different payment method.

25. PayPal Pay Later

PayPal which you can use to pay for things pretty much anywhere these days, also offers a buy now pay later option.

You can get a 6 week payment plan with no interest charges and instant approval.

Best Sites for Buy Now Pay Later No Credit Check Instant Approval

If you are just looking for the best buy now pay later catalogs with no credit check instant approval here are your best bets:

Popular Catalogues for Bad Creditors

There are several Buy Now Pay Later catalogs that are designed for people with bad credit. Here are some of the most popular options:

| Catalogue | Description |

|---|---|

| ABT Electronics & Appliances | Offers a wide range of electronics and appliances. |

| Amazon | Offers a wide range of products, including electronics, clothing, and home goods. |

| Big Lots | Offers a wide range of products, including furniture, home goods, and electronics. |

| Boscov’s | Offers a wide range of products, including clothing, shoes, and home goods. |

| The Bradford Exchange | Offers a wide range of collectibles and jewelry. |

| Conn’s Home Plus | Offers a wide range of furniture, appliances, and electronics. |

| Country Door | Offers a wide range of home decor and furniture. |

These catalogues offer a variety of products, and you can find something to suit your needs and budget. Keep in mind that each catalogue has its own terms and conditions, so be sure to read the fine print before you apply.

Pros and Cons of Catalogs for Bad Credit

If you have bad credit, getting approved for credit can be a challenge. Fortunately, there are online shopping catalogues that are designed for people with bad credit. These catalogues allow you to buy products and pay for them over time, even if you have a poor credit history.

Here are some of the pros and cons on BNPL catalogues.

Advantages of Using Catalogs Buy Now Pay Later

One of the main benefits of a pay weekly catalogue, or pay monthly catalogues, is that they can provide a way for people with a bad credit history to access the products they need.

Many catalogues do not require a credit check, which means that even if you have a poor credit rating, you may still be able to get approved for a line of credit.

In addition, they often offer flexible payment options. You can typically spread the cost of your purchases over several months. This can be especially helpful if you have unexpected expenses or if you are on a tight budget.

Potential Risks and Downsides

One of the downsides of buy now pay later online catalogues are that they often come with high interest rates and fees.

Another downside of using catalogues is that they can encourage overspending. Because you are able to buy now and pay later, it can be tempting to make purchases that you might not be able to afford. This can lead to debt and financial problems.

Some online catalogues may do a hard credit check as well to see your credit history and credit rating which can lower your score.

Finally, it’s important to remember that using these catalogues can have an impact on your credit score. If you miss payments or don’t make on time payments it may go on your credit history or further hurt your credit report.

Improve Your Credit with Financing Catalogues

If you use a Buy Now Pay Later Catalogue responsibly, it can improve your credit score. By making payments on time, you can demonstrate that you are a responsible borrower.

Some catalogues report positive payment history to credit bureaus, which will boost your credit score.

However, it’s important to make sure that the catalogue you choose reports to all three credit bureaus (Equifax, Experian, and TransUnion), as this will ensure that your payment history is reflected in your credit report.

Frequently Asked Questions

What are some online stores that offer payment plans?

There are many online stores that offer payment plans, including popular retailers like Overstock, Home Shopping Network (HSN), QVC, and Fingerhut. These stores offer a variety of products, from clothing and accessories to electronics and home goods.

What catalogs offer credit without a credit check?

If you have bad credit or no credit, you may have difficulty finding catalogs that offer credit without a credit check. However, there are some options available, such as Conn’s Home Plus, Leaseville, and Zebit Market. These catalogs offer instant approval for payment plans and financing options without a credit check.

Are there any buy now, pay later apps that don’t require a credit check?

Yes, there are several buy now, pay later apps that don’t require a credit check. Some of the most popular options include Afterpay, Klarna, and Quadpay. These apps allow you to make purchases and pay for them over time.

Afterpay is probably one of the best as you can use this on multiple sites to buy something. In addition there is Perpay and Sezzle.

If you’re looking for stores that offer instant credit for online shopping, you may want to check out options like Fingerhut, HSN, and QVC.

The best bnpl site for bad credit is includes Sezzle, Fingerhut, Afterpay, Perpay and Klarna.

The minimum credit score needed for buy now, pay later options can vary depending on the retailer or lender. Some companies may require a minimum credit score of 600 or higher, while others may offer financing options to those with lower credit scores.

Conclusion

In conclusion, Buy Now Pay Later companies can be a great option for people with bad credit who need to make purchases but don’t have the cash upfront.

These shopping catalogues allow you to spread out payments over time, making it possible to buy things you need.

When choosing a BNPL catalogue, it’s important to consider factors like interest rates, fees, and repayment terms. Some catalogues may have higher interest rates or fees than others.

Additionally, it’s important to make sure that you can afford the payments before agreeing to a Buy Now Pay Later plan. Late payments or missed payments can negatively impact your credit score.

More Posts:

How to Have a Natural Facial at Home

A Guide to Financial Independence for Women

Business Planners for Entrepreneurs

Free Home Repair Grants to Take Advantage of

10 Beauty Tips Southern Women Swear By