This post may contain affiliate links. Please read my disclosure for more information.

If you want to try your hand at real estate investing but don’t have the capital you need to buy a house, you should look into real estate crowdfunding platforms like CrowdStreet and Fundrise.

These sites allow you to become a real estate investor without having a ton of money! Or dealing with the headaches or a renovation.

I did my own fix-and-flip project a few years back and I can tell you it was very stressful and required a lot of money. Leveraging a site like Crowdstreet sounds WAY easier.

You don’t have to have a hefty bankroll or insider connections to try property investments.

A real estate investment platform opens up the playing field for pretty much any investor, allowing you to start with a relatively small amount of money.

It’s tailored for people who are new to the real estate market and offers a straightforward approach to portfolio-based investing in commercial and residential properties.

And, the average return over the past 7 years for all these platform investors is 4.08%.

So, if you do want to invest in real estate with one of these crowdfunding platforms, which is better, CrowdStreet or Fundrise?

We’ve put together a comparison of these two real estate crowdfunding platforms to help you choose!

Fundrise vs. CrowdStreet at a Glance

Here is a quick glance at a comparison of Fundrise and CrowdStreet.

| Fundrise | CrowdStreet | |

|---|---|---|

| Minimum Investment | $10 | $25,000 for most projects |

| Fees | 0.15% advisory fee 0.85% to 1.85% management fee for funds | Varies by deal as fees are charged by individual project sponsors |

| Accredited Investor Requirement | No | Yes (must meet minimum requirements) |

| Assets and Investment Types | REITs and Funds: Single family, Multi-family, Industrial | Single family, Multi-family, Industrial, Focused on commercial |

| Account Types | Individual, Joint, Entity, Trust, IRA | Individual, Joint, Entity, Trust, IRA |

| Best for | New investors and those with less capital to invest | Accredited investors with more available capital |

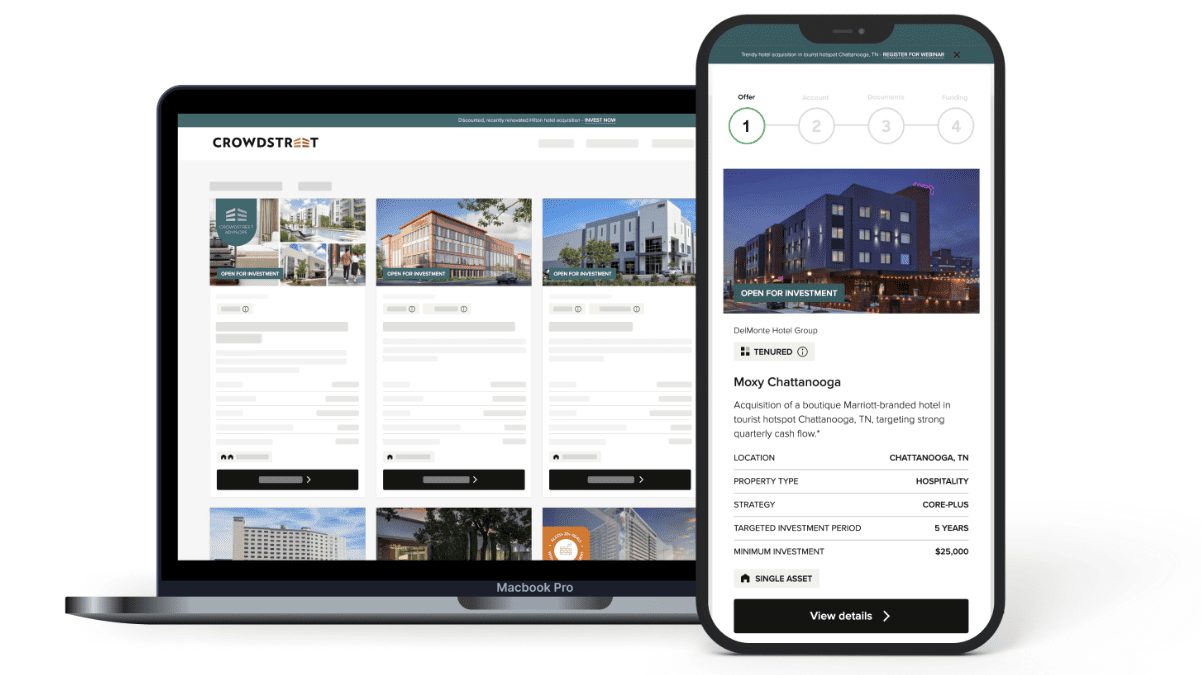

What is CrowdStreet?

CrowdStreet is a real estate investing platform that gives you—the accredited investor—a shot at putting your money into projects and investment opportunities from real estate professionals.

CrowdStreet’s claim to fame is its focus on individual deals in the commercial realm, which covers pretty much anything from office buildings to shopping centers.

Investing in large projects like commercial real estate and multi-family buildings can require a TON of capital.

But with the CrowdStreet marketplace, individual investors get into these deals with a fraction of the cost. And reap a nice return on your investment!

The cool part is that it’s all done through crowdfunding, so instead of buying a whole building yourself, you get to pool your cash with other investors.

You can invest in REITs or individual property deals and start making a supplemental income. Crowdstreet has raised over $4 Billion in capital.

Here’s some key details:

- Target investors: Accredited investors only

- Deal focus: Individual commercial real estate deals

- Investment style: Crowdfunding platform

The platform’s been making waves because it lets you take direct picks of the real estate deals you fancy, rather than bundling the investment options into a fund.

So if you’re the hands-on type who likes to get into the details and have more control over investments, this might be up your alley.

One big difference between CrowdStreet and Fundrise is that Crowdstreet focuses on letting you invest in commercial deals including even things like self storage and other business properties. Even large scale industrial projects are an option!

However, you will have to be meet accredited investor requirements to be approved which is one of the downsides of Crowdstreet.

Remember, Crowdstreet’s all about giving you access to fancy commercial properties. But hey, don’t go running in blind. Do your homework, weigh the risks, and look before you leap.

Invest in Real Estate the Easy Way!

Crowdstreet: Earn a return on capital. Make money while you sleep!

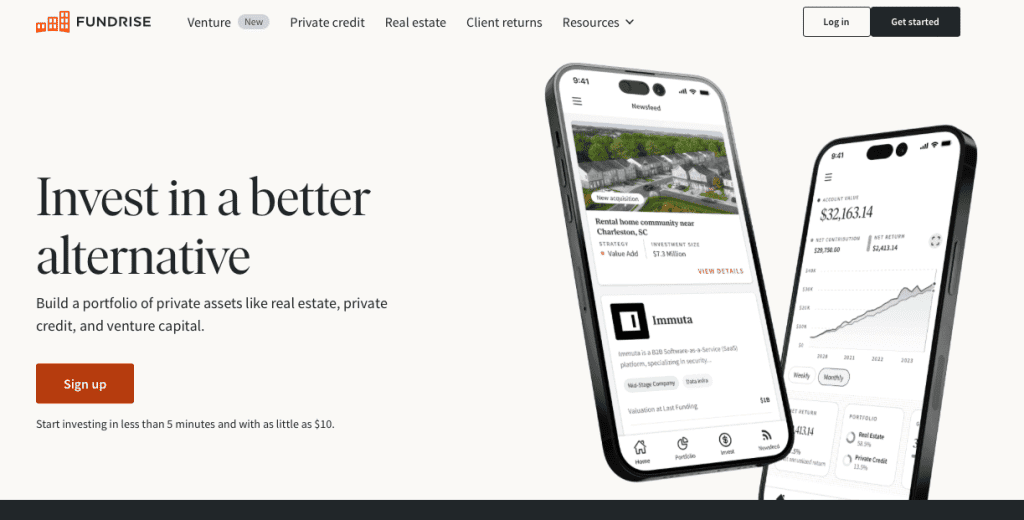

What is Fundrise?

When you’re looking at real estate investment platforms, Fundrise is a well known site. They currently have over 381,000 users and $7 Billion in total portfolio value.

It’s a user-friendly platform designed mainly for non-accredited investors. That means you don’t need a hefty income or net worth to get started. And, you can invest with as little as $10.

With Fundrise, you’re essentially buying into a Real Estate Investment Trust (REIT), which is a company owning, operating, or financing income-generating real estate.

So instead of buying into one specific project, you buy into a portfolio or real estate fund that Fundrise chooses. Unless you opt for Fundrise Pro which lets you be more customized.

Fundrise offers several key benefits:

- Accessibility: You can try real estate investing with a low minimum investment.

- Diversity: Your money goes into a mix of commercial and residential properties across the United States.

- E-REITs: These are exclusive to Fundrise and aim to provide investors with a blend of income and growth.

There are three investment plans to choose from based on your investment strategy:

Supplemental income plan: Focused on projects that create a consistent stream of income.

Balanced investing: High diversification and balances focus between stable income-producing properties and growth-oriented assets.

Long-term growth: Better returns over the long term, more focused on real estate assets with potential to appreciate in value over time.

If you’re eyeing a more advanced investment strategy, Fundrise Pro is an option for qualified investors. It offers access to more sophisticated investment strategies.

Fundrise makes real estate investing more achievable for the everyday person. They’ve simplified the process: you put your money in, and they take care of the property selection and management.

You’re left to watch your real estate portfolio potentially grow from the comfort of your home. And one of the biggest advantages of Fundrise vs other platforms is the low investment minimum of only $10!

Keep in mind, like any investment, real estate comes with its own set of risks, and there’s no guarantee of returns. But, if you’re looking for an intro to the property market, Fundrise is worth considering.

Related reading:

- How to make Passive Income on Amazon

- How to Double $10K Quickly

- Masterworks Review: Investing in Fine Art

Real Estate Investing Platform Comparison of CrowdStreet and Fundrise

When you’re comparing CrowdStreet and Fundrise, you’re looking at two distinct flavors in the world of real estate investing. Let’s break it down by each factor.

Minimum Investment and Capital Requirement

When you’re stepping into the world of real estate investment platforms, it’s important to understand the cash you need upfront. Fundrise and CrowdStreet stand out, but they cater to different levels of investment readiness.

With Fundrise, you’re looking at a super accessible minimum investment. If you’re just starting out or you’re not ready to throw big money down, you can breathe easy.

Fundrise lets you invest with as little as $10 for their regular investment accounts. If you are interested in an individual retirement account (IRA), $1,000 is your kickoff.

CrowdStreet on the other hand plays in a different league. Most (but not all) of their projects have a minimum investment requirement of $25,000.

This sets the stage, signaling that CrowdStreet caters to those with a bit more capital to invest. Plus, you have be an accredited investor.

That means meeting certain income or net worth requirements before being allowed to take advantage of investment opportunities.

Whether you’re a non-accredited investor starting small or an accredited investor ready to jump in big, each platform has its own appeal dependent on the capital you have at hand.

But, for new investors without a lot of money, Fundrise is your best choice.

Make the Most of Your Money

Empower: Get the money management tool to help you control your personal finances. Net worth, future plans, savings planner, and investments, all in one award-winning dashboard.

Access and Eligibility

One difference between CrowdStreet and Fundrise, involves who can invest and what’s required.

Fundrise: Good news! Fundrise is open to non-accredited investors, meaning you don’t need a big income or net worth to join in.

It’s built for the individual investor with ease of access across all 50 states. So, if you’re new to real estate investment, Fundrise might be your ticket in without needing accreditation.

CrowdStreet: CrowdStreet, on the other hand, typically requires you to be an accredited investor.

That means you’ve got to meet certain financial criteria, like earning an income over $200,000 annually or having a net worth exceeding $1 million, not counting your primary residence. It’s a bit more exclusive, catering to a more experienced crowd who meet these standards.

Fundrise is a clear winner when it comes to being accessible for anyone.

Types of Real Estate Assets

When it comes to investment types, Fundrise and Crowdstreet offers are similar. They both let you invest in residential and commercial deals, and in REITs.

However, Crowdstreet allows you to pick specific projects or deals you want to invest in. Fundrise on the other hand picks the investments for you based on the portfolio you want to buy into.

Crowdstreet is also more focused on commercial real estate. You can invest in business properties like hotels, industrial projects, self-storage deals and large mixed-use apartment buildings or multi-family deals.

Understanding Fees and Cost

The fee structures and potential returns of Fundrise vs. Crowdstreet are important factors. They can make a considerable difference in your overall investment experience and gains.

Fundrise breaks down their costs like this:

- Advisory fee: 0.15%

- Management fee: 0.85%

Together, these add up to 1% annually. So if you’re putting in $1,000, you’ll be shelling out $10 every year for these services, which ultimately isn’t that much.

CrowdStreet, on the other hand, doesn’t have a uniform fee structure listed publicly since it varies by deal.

They make money by charging the investment sponsors. (The people putting the deals together.) However, what you might see a fee for this on the specific deal page of what you want to invest in.

A Comparison of Returns and Performance

Now, let’s talk dollars and cents – or rather, the returns on your investment. Sure, you want to keep fees low, but what you’re really here for is to watch your money grow.

Fundrise has reported average annual returns between 8.81% and 16.11%, varying by the specific fund or deal. You can check out their overall yearly returns here.

Keep in mind, your mileage may vary based on the ebb and flow of real estate and economic conditions.

CrowdStreet sports a slightly different bragging right, boasting an average annual return of around 17.3% across all deals.

Again, this is an average – the real estate game can be as predictable as a coin flip. You can check out details on their marketplace performance here.

CrowdStreet offers higher returns overall than Fundrise.

Set Your Savings and Investments to Automatic with Acorns

Download the Acorns app, link it to your bank account and earn money while you sleep!

Acorns rounds up your spare change and moves it into an investment account for you. Download today and get a $5 bonus!

Diversification and Risk Management

It is important to look at how each platform handles diversification and risk.

Diversification is like your financial safety net. It spreads your bets across various asset investment types and projects to minimize the impact if one doesn’t perform as expected.

Fundrise hooks you up with diversified funds, which works to your advantage if you’re not keen on putting all your eggs in one basket.

You’ll get access to an array of eREITs and eFunds, each containing a mix of properties. This kind of allocation can align nicely with your risk tolerance.

However, keep in mind that your investment is less tailored since it’s spread across Fundrise’s chosen properties.

On the flip side, CrowdStreet lets you pick specific projects. It can be thrilling to choose exactly where your money goes, but it also means the responsibility for diversification rests on your shoulders.

You can build a diversified portfolio if you wish, but that would require a higher capital commitment given CrowdStreet’s steeper minimum investments.

Remember, both platforms give you a shot at the real estate market, but they cater to different approaches. Are you up for hands-off investing and broad diversification? Fundrise is your go-to.

If you prefer to handpick your investments and manage risk through personal allocation decisions, look into CrowdStreet — as long as you have the cash to diversify on your own terms.

Liquidity

When you’re exploring real estate investment platforms like CrowdStreet and Fundrise, it’s key to consider your investment liquidity.

Essentially, how long can you park your money, and how quickly can you convert your investments back to cash?

With Fundrise, you’re looking at low to moderate liquidity. This means that if you need to get your money back, you might find yourself waiting for a bit.

Their real estate investment funds have a five year lockup period. However, they give you the option of a quarterly early redemption.

This is not always guaranteed to be an option however, and there may be a small fee charged.

CrowdStreet, on the other hand, gears itself more towards investors with a tolerance for longer illiquid periods. They have a holding period of 3-5 years but for some projects it could be as long as 10 years.

Here, your investments are typically tied up for longer, often several years. This approach is much like buying property directly; you’re in it for the longer haul, and quick cash-outs aren’t part of the game plan.

Fundrise provides more liquidity than CrowdStreet since they offer the early redemption option.

Invest in Real Estate the Easy Way!

Crowdstreet: Invest in large commercial projects and industrial.

Earn as much as 17% in returns.

Pick your own projects and deals.

Investor Tools and Resources

When you’re sizing up Fundrise and CrowdStreet, check out the tools and resources each offers to make your investment journey easier.

Fundrise

With Fundrise, even if you’re not rolling in dough, you can get started. You’ve got an investment plan catered to different levels of net worth. And hey, if you like a hands-off approach, you’re in luck:

- Mobile App: Super handy for tracking your investment portfolioon the go.

- Dividend Reinvestment: This is a set-it-and-forget-it kind of deal. Automatic reinvestment means your returns could compound without extra effort on your part.

- Balanced Investing: Aimed at keeping your portfolio diversified according to the goals you choose.

CrowdStreet

If you’ve got more to invest and prefer picking investment options like a pro, CrowdStreet’s got what you need.

- Investment Selection: Choose individual real estate projects for a tailored fit to your portfolio.

- Educational Resources: These give you the lowdown on projects so you can invest smarter, not harder.

- Investor Dashboard: A slick tool for a clear view of your investments’ performance and to help you plan out your next move.

Support and Community for Investors

Looking at CrowdStreet and Fundrise, the support system and strength of the community can make a big difference.

Here’s what you can expect.

CrowdStreet

Community: CrowdStreet gives you access to a large community of wealthier, typically accredited investors. You’ll find that networking opportunities are plentiful and there’s a sense of being part of an exclusive club.

Investor Support: They have a solid customer service team that can guide you through your investment process. Plus, educational resources are available to help better understand the intricacies of real estate investing.

Fundrise

Community: Fundrise is known for opening doors to real estate investments to a broader audience, including non-accredited investors. It tends to have a more diverse community, not restricted to the wealthy.

Investor Support: You get hands-on support through educational content that’s great for newbies. Any questions? Their customer support is praised for being responsive and helpful.

Tax Implications and Benefits

When you’re dabbling in real estate investments through crowdfunding platforms, understanding the tax implications can help you manage your investments more effectively.

With Fundrise, you can invest using an IRA account, which is pretty sweet for tax reasons. You could be looking at tax-deferred growth and potentially tax-free withdrawals when retirement rolls around. That’s a nice perk for your future self!

CrowdStreet, on the flip side, doesn’t offer IRA accounts directly, but since you’re dealing with property investments, typical real estate tax benefits apply.

You’re in the pool with other real estate investors, so things like depreciation or expenses related to your investments might help you lower your taxable income—a handy trick for April.

Here’s the lowdown in a glimpse:

- Fundrise:

- IRA options: Go for tax-deferred or tax-free growth.

- Investment type: Indirect through eREITs; might not offer direct tax advantages of property ownership.

- CrowdStreet:

- Tax benefits: The usual real estate goodies—deductions and depreciation.

- Investment type: Direct investments, leading to potential property-specific deductions.

3 KEy Differences Between Fundrise and CrowdStreet

There are 3 things you can look at to see major differences between the platforms that might help with your decision on which one to use.

1. Fees

There is a difference between the two when it comes to the cost. Fundrise will charge you between 1 and 2% a year.

Crowdstreet does not charge you fees, however the individual project sponsors may pass their CrowdStreet fees along to you.

So you will have to look at the individual deals to see what fees you will be charged.

2. Accessibility and Requirements for INvestment

One major difference between the two sites is who can invest. Fundrise is the winner for accessibility. You don’t have to be an accredited investor or meet any requirements.

And, the minimum investment you need is only $10!

On the other hand, CrowdStreet will require to you be an accredited investor. Which likely means an income of at least $200,000 a year. You will need more capital to invest as well as most projects have a minimum of $25,000.

3. INvestment Types

Another key difference between CrowdStreet and Fundrise is the types of assets you can invest in.

On Fundrise, you can’t pick your individual projects. You will be buying into a fund or REIT that consist of several.

You can see some of the projects however on the website.

In contrast, you can choose individual deals and projects on CrowdStreet and just invest in the property you want rather than an entire fund.

Which is Better, CrowdStreet or Fundrise?

When choosing between Fundrise and CrowdStreet, you’ve got a lot to consider, like the types of investments available, potential returns, fees, and the overall processes of each platform.

Not to mention the minimum investment required which may eliminate one of these from your options. The answer to the question of which platform is better depends on you really.

If you enough income and cash to meet the requirements of CrowdStreet, it may be the better choice since it typically has higher returns and you can pick which projects you want to invest in.

However, if you have less money and are a new investor, then Fundrise is the better choice for you. Weigh all of the pros and cons of each and figure out which is the best real estate platform for you individually.

Either way if you want to start investing in real estate and make passive income, you can’t go wrong with these!

What Is Real Estate Crowdfunding?

You’ve probably heard of crowdfunding, where a bunch of people pool their money together to support a cause or a project.

Real estate crowdfunding works pretty much the same way, except the pool of money is used to fund real estate investments.

This strategy opens the door for you to get into the real estate investing game without the need to buy an entire property yourself.

- Types of Real Estate Projects Involved:

- Commercial Real Estate: Think of office buildings, retail spaces, or warehouses.

- Residential: Includes single-family homes, apartments, and condos.

Each investor contributes a relatively small amount, and when enough people invest, voila, you’ve got a chunk of change big enough to get into some serious real estate action.

These real estate crowdfunding platforms, like CrowdStreet and Fundrise, serve as a bridge between you and your potential real estate investments.

Real estate crowdfunding can democratize the investment process, making it accessible and potentially profitable for you even if you’re not rolling in dough.

It can be a way to flip money and earn extra income. But as with all investments, remember to do your due diligence before diving in.

What is an REIT?

When you start real estate crowdfunding, you bump into something called REITs, or Real Estate Investment Trusts.

These trusts are basically companies that own, operate, or finance income-producing real estate across a range of property sectors.

- Publicly Traded REITs: Think of these as the big dogs you can buy or sell on major stock exchanges. They’re like stocks, and they give you a way to get into real estate without buying a building yourself. Plus, they pay out dividends which is basically your slice of their profit pie.

- eREITs: These are a digital spin on the traditional REIT and are often specific to platforms like Fundrise. eREITs are not traded on the stock market, so they’re less volatile. However, your money might be more tied up, as they’re harder to sell quickly.

- C-REIT: This is a newer term you might see; it stands for “Crowdfunding REIT.” This type is similar to eREITs, built for the online world of crowdfunding, typically found on platforms like CrowdStreet and Fundrise.

REITs in crowdfunding are used to pool your capital with other investors to buy into real estate ventures.

This way, you’re not forking over loads of cash to buy a building. Instead, you chip in what you’re comfortable with.

Why REITs rock in crowdfunding:

- Dividend payments: You get regular income from the profits of real estate assets.

- Diversity: Your investment gets spread across various properties, giving you a diversified portfolio and reducing risk.

- Accessibility: You don’t need to be mega-rich or an accredited investor, especially with eREITs.Which is better, CrowdStreet or Fundrise?

Frequently Asked Questions About Fundrise Vs. CrowdStreet

Here is an FAQ about the two real estate investing platforms.

Fundrise caters to both accredited and non-accredited investors, with a lower minimum investment, making it accessible if you’re just starting out or don’t have much to invest.

CrowdStreet, in contrast, targets accredited investors and typically requires a higher minimum investment, focusing on individual commercial projects.

CrowdStreet investments generally do not provide monthly dividends, as payout schedules are project-dependent. However, some investments may offer periodic distributions, which could be monthly, quarterly, or annual, based on the particular investment’s cash flow.

Fundrise charges an annual fee that includes an investment advisory fee and an asset management fee, usually totaling around 1%.

CrowdStreet, doesn’t charge a fee as they charge the project sponsors. However, that fee may be passed along to the investor. You will have to look at individual deals to see if there are additional fees.

CrowdStreet investments have historically averaged an annual return of around 17.3%, while Fundrise has provided annual returns ranging from approximately 8.81% to 16.11% depending on the funds selected. Remember, these are historical averages and actual returns can vary.

Fundrise allows you to invest in a diversified portfolio, which spreads your investment across multiple real estate projects, while CrowdStreet allows you to handpick individual real estate deals. This means you can select specific properties on CrowdStreet, as opposed to the mixed-asset approach of Fundrise.

Bottom line: Fundrise vs. CrowdStreet

Now that you know all the features of each platform, you can pick the one that is right for you! Figure out your investment goals and start investing in real estate today!